FOODSERVICE delivery has been on the growth trajectory even prior to the current pandemic. Its sudden and dramatic growth in the past year could be perceived as a foretaste of where the market is heading in the next years.

Online platform-to-consumer delivery has made it extremely convenient for consumers to order from hundreds of restaurants and food shops, while many restaurants have also quickly adopted by having their own delivery service. This trend is definitely benefiting many sectors of the food and beverage industry. In this interview, Josh Strong, Senior Marketing Manager, Foodservice (Southeast Asia), Kerry APMEA shares insights from the company's own market study.

Josh Strong, Senior Marketing Manager, Foodservice (Southeast Asia), Kerry APMEA

What factors are driving demand for food delivery?

Kerry recently conducted a study across countries in Southeast Asia (Singapore, Malaysia, Philippines, Indonesia, and Thailand) to better understand the regional home delivery ecosystem pre-COVID and today. The focus was on consumer needs, when people consume, preferences and sensorial factors.

We found four key factors driving demand for home delivery:

Convenience Best defined in the context of 'paucity of time', the need for a time-saving solution that offers consumers greater convenience, emerged as the key need in our research. Ordering food at home is regarded as an easy process by consumers in the region. Having great-tasting food delivered when there is no time to cook, and eliminating the hassle of navigating traffic to get to the restaurant, are big pull factors for consumers in some of Asia's densely populated and crowded cities.

Restaurant-like experience Even at home, consumers are looking to somehow replicate the experience they would get in a restaurant. Take sensory appeal. They are looking at aesthetics, aroma, and textures that come close to what they expect in food when dining out. For example, crunchy chicken or crisp fries, not soggy ones; or smooth noodles versus a cold, lumpy serving. With more brands and cuisines offering delivery, consumers can also mimic the variety and types of dishes they would select when eating out.

Value Equation Consumers see delivery as a cheaper, value-for-money option compared to dining out. You still get to enjoy the same delicious meal you would get in a restaurant minus the cost of commute, plus delivery often comes with attractive deals, discounts, and combos.

Safety With COVID-19 an ongoing concern, consumers across Southeast Asia are looking to delivery as a safe way to enjoy their favourite meals without the risks associated with dining out. The assurance of safe and hygienic consumption was a key need highlighted from our study ─ from packaging to the handling of the delivered items. In fact, safety emerged as the second most important factor for choosing home delivery.

Do you see the home delivery trend rising in the next few years?

As it rapidly becomes the go-to channel for consumers, food delivery will continue to grow and expand in the foreseeable future across the region. Joint research by Google and Singapore's Temasek Holdings reports that food delivery is set to become a USD8 billion market by 2025, up from USD2 billion in 2018. With the pandemic, this number has most likely been accelerated.

During long distance delivery, province to province, or from state to state, products can be in transit for some time. Texture, among other organoleptic properties, is important, for example where crunch or tenderness is expected.

Can you tell us about Kerry's solutions that help maintain texture, and keep food fresh and flavourful?

Every product has a unique set of factors affecting its texture and flavour during extended holding conditions. Take for example, meat. There's substrate type and recipe which includes the meat's moisture content, addition of binding agents and other functional ingredients. With processing method and conditions, you're talking about par-fry, fully cooked in oven, fully fry, as well as temperature, time, humidity. Then there are holding conditions, involving equipment used, humidity, temperature and duration. All of these may interact to contribute to the quality of the product delivered to the consumer.

For this reason, we must understand the specific circumstances that apply to a product and then deploy the appropriate solutions. There is no 'one size fits all' solution.

At Kerry, our global R&D team has been working to understand the complex relationship these factors have on product quality. Our solutions have been tested on several platforms across restaurant, QSR, C-Store and cloud kitchen environments.

These include:

- Processor vs. Back-of-house preparation

- Holding Time and Environment

- Delivery Time and environment

Take poultry for instance. We identified several ingredient solutions to improve coating texture, succulence and overall flavor of poultry products intended for delivery and carry-out.

These include:

- Brine systems to improve succulence and reduce yield loss

- Flavour solutions to maintain taste impact

- Coating systems to retain crispiness and prevent discolouration (for C-store long hold time)

Stability and consistency are also important factors in the delivery environment. Foodservice operators are challenged to ensure the consumer receives a product that maintains all the quality and taste they would expect from dining out in a restaurant. In a Kerry case study, longer delivery times coupled with excessive movement during transportation resulted in a customer’s signature milk tea beverage spoiling, with the cream cap topping bleeding into the drink. We were able to help our customer overcome this challenge with our DaVinci Gourmet Instant Snow Cap powder. A versatile solution that worked across both their hot and cold beverage offerings, the Instant Snow Cap powder was easy to apply in-store, increased consistency and stability of the beverage cap during delivery, and without any bleeding occurring, the beverage maintained its body.

Aside from palatability, is it usual for consumers to seek nutrition in their

choice of home-delivered food?

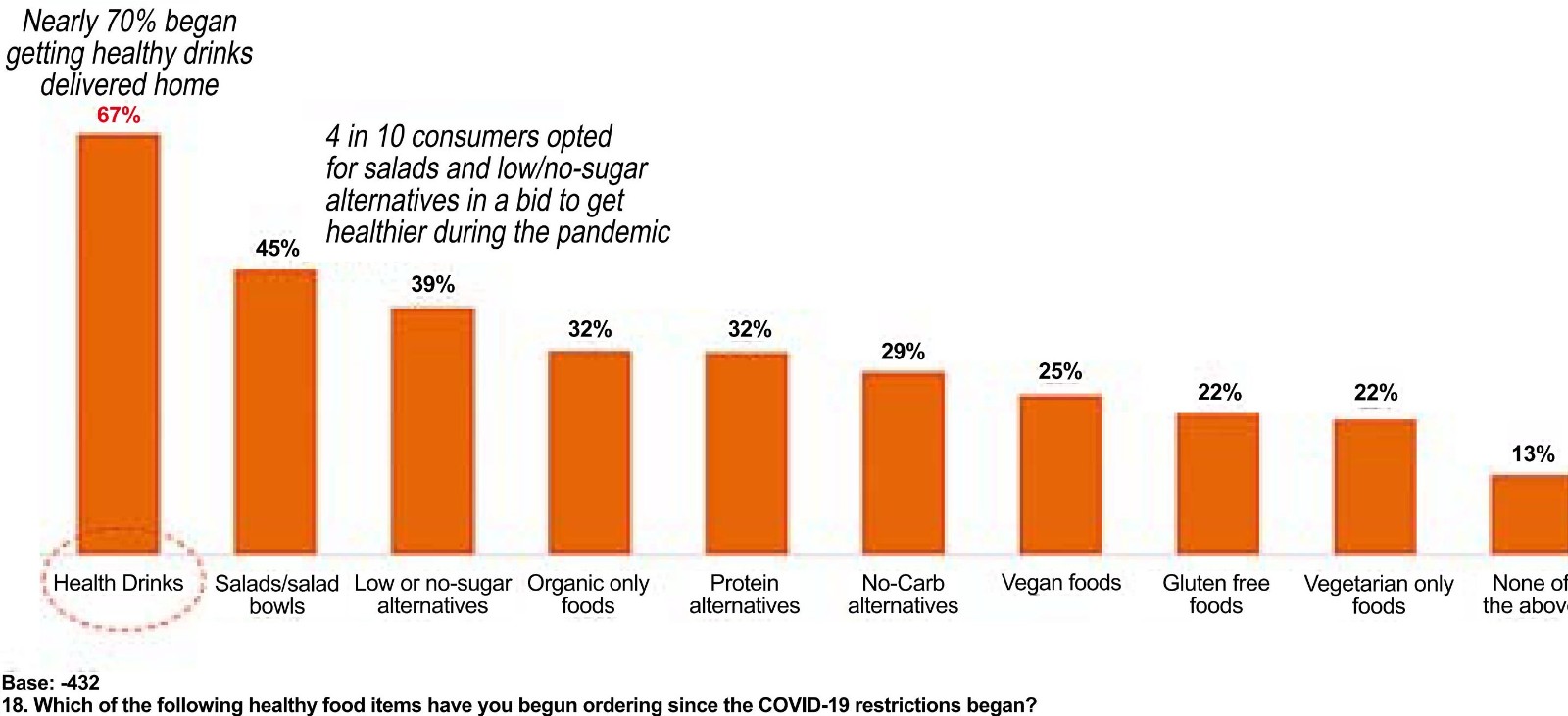

Across our key Southeast Asia markets, we are seeing a growing awareness around nutrition and a demand for healthier menu choices from consumers. From our study, we understand that consumers expect their delivery options to also align with these nutrition and health goals. Almost a quarter of all consumers in the region chose 'more healthy options in the menu' as one of the top ways to enhance their home delivery experience, pre-pandemic.

However, COVID-19 has spurred further trials of healthier menu options, especially in the healthy beverage category, followed by salads and low or no-sugar alternatives. We predict this demand will continue to increase.

Read about The Global State of Foodservice Delivery https://www.kerry.com/insights/

kerrydigest/2020/global-foodservice-delivery

iConnectHub

iConnectHub

Login/Register

Login/Register Supplier Login

Supplier Login