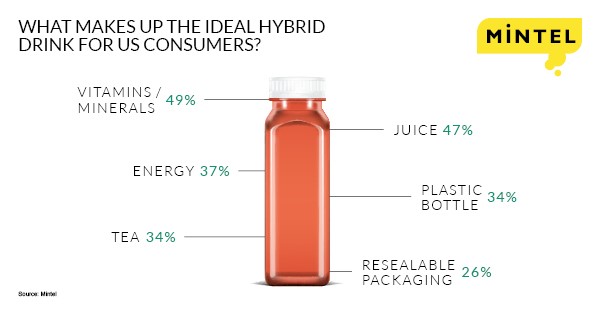

RESEARCH from Mintel reveals that consumers with fast-paced lives often seek functional beverages with vitamins and minerals (49%) the attribute they look for the most in their ideal hybrid drink*. As the popularity of functional and hybrid drinks increases, opportunities for product innovation could offer a boost for some beverage categories.

In the US, among the hybrid drinks consumers report drinking regularly or those they have tried, bottled water with added health benefits (eg protein, vitamins, antioxidants) (44%), carbonated juice (40%) and juices with added functional benefits (eg energy, relaxation) (35%) are among the most popular.

Juice drinks and smoothies are forecast to have increased a mere 1.2% in 2016, representing minimal gains of 4% since 2011, according to Mintel. While product innovation has led Americans to other drink segments in search of flavor and format variety, there may be an opportunity for a juice revival through the introduction of hybrid drinks as hybrid drinks consumers are most interested in juice-based hybrid drinks (47%) than any other base**.

“As consumer preferences shift toward better-for-you food and drink, consumers are increasingly searching for functional, healthful beverages. Some of the larger US beverage categories, such as carbonated soft drinks and juice, are losing share to trending beverage types due to the fact that they deliver on consumer demand for more flavor and functional innovation, combined with lower sugar/calorie content. However, there are clear opportunities for the juice category among hybrid drink users, suggesting that blurring lines through product innovation that combines juice with other drink types that have a higher inherent perception of health may expand appeal among consumers,” said Beth Bloom, Senior Food & Drink Analyst at Mintel.

Antioxidants (42%), energy (37%) and electrolytes (33%) also top the list of attributes Americans say they look for in the ideal hybrid drink. What’s more, older iGens*** aged 18-21 are significantly more likely than consumers overall to point to mood-enhancing attributes in their ideal hybrid drink, such as energy (51%) and relaxation benefits (35%).

Hybrid drinks also seem to be an unplanned pick-me-up as American consumers say they are most likely to have hybrid drinks in the afternoon (36%), on-the-go (27%) and as a treat (27%). One in three (34%) consumers say their ideal hybrid drink would be packaged in a plastic bottle and over one quarter (26%) are interested in resealable packaging.

“Manufacturers of hybrid drinks have a range of opportunities when developing products that best meet consumer needs. Our research indicates that for the majority of consumers, the ideal hybrid drink would have a juice base, would contain vitamins and minerals and would be packaged in a plastic bottle. Following those leading areas of interest are a wide variety of attributes, as well as drink and packaging types, that could find appeal among consumers. Positioning these drinks in retail locations that attract grab-and-go shoppers can ensure maximum exposure,” continued Bloom.

In addition to providing optimal flavor and function, hybrid drinks can offer new opportunities for product trial as over one quarter (26%) of hybrid drinks consumers say they’re bored with the non-alcoholic beverage options currently available. More than three in four (76%) hybrid drinks consumers say they like to try new drink types and two in three (63%) agree that hybrid drinks encourage them to try new drinks that they normally would not try, with Millennials**** the most likely generation to agree with this statement (72%).

There does, however, appear to be some wariness surrounding blurred beverages as four in five (80%) hybrid drinks consumers believe hybrid drinks are more expensive than other drink types and well over half (57%) of non-hybrid drinks consumers view hybrid drinks as gimmicks to get them to spend more money.

“Hybrid drinks are a strong means of keeping younger consumers engaged in non-alcoholic drink categories, and in encouraging beverage exploration; however, hybrid drinks have an uphill battle ahead of them when it comes to price. Proving value will be a strong means of encouraging trial as hybrid drinks can act as a bridge to promote expansion into new beverage categories,” concluded Bloom.

*Drinks that combine two or more drink categories

**Other base options include water, tea, cola, energy drink, coffee and other

***The iGeneration are between the ages of 9 and 21 in 2016

***Millennials are between the ages of 22 and 39 in 2016

Roshe Run Kaishi