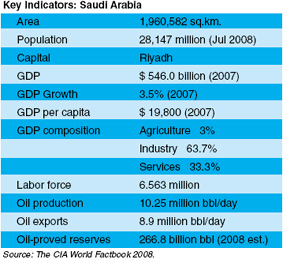

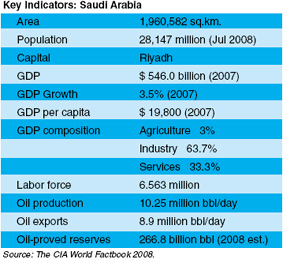

The falling oil prices have affected major oil producing countries in the Middle East to the extent of slowing down major infrastructure and industrial projects. Oil producers in the region are helpless in the wake of rapid price decline and have called for closer cooperation to stabilize crude prices. It has been reported that a number of upstream and downstream projects have already been postponed or cancelled and with the United States still in recession, demand for oil is not like to pick up substantially in early 2009. A combination of declining oil prices, lower crude demand and production cuts will cost the Organization of Petroleum Exporting Countries (OPEC) another $151 billion in lost oil export revenues this year, according to the US Energy Information Administration (EIA). The EIA has revised its monthly forecast for OPEC''s oil export revenue this year by 25% to $444 billion, which would be the lowest level since 2004. OPEC members, led by Saudi Arabia, are pushing for substantial reduction in crude output volumes to stem the rapid price decrease. Even with the anticipated budget deficits this year that Saudi Arabia and other Gulf oil producers are like to experience, the huge surpluses accumulated during the six years of high oil prices are expected to support government spending in the years to come. Governments in the Gulf region are seen to continuously pour billions into developing financial centers, setting up tourist spots, building up industry and petrochemicals and speeding up construction projects. There may be some slow down but the Middle East region is expected to sustain its high spending in these areas. "Saudi Arabia is the world''s largest producer and exporter of total petroleum liquids" With Saudi Arabia committing to spend $400 billion on development and investment in the next five years, the industries in the region remain optimistic. With an oil-based economy, Saudi Arabia posesses more than 20% of the world''s oil reserves and currently ranks as the largest exporter of crude oil in the world. The sector contributes to about 75% of the government''s revenues and 45% of the gross domestic production. About 90% of export earnings come from oil. Diversification as strategy The past few years saw high oil prices and this provided an impetus for economic growth. Revenues from oil helped the government explore other opportunities and encouraged expansion in such sectors as power generation, telecommunications, natural gas exploration, and petrochemicals. The government has targeted to reduce the kingdom''s dependence on oil exports, and industry diversification has been seen as the most ideal move. While economic uncertainty currently deters petrochemicals producers from pursuing their expansion plans, the slack may not be long term. Last year, when oil hit $150 a barrel, Gulf producers were pumping out large volumes of base polymer products almost regardless of the price they were fetching, now they have to slow down production due to sluggish demand and low prices. However, the industry players are taking a long-term view of the situation especially with new plants in Saudi Arabia, Qatar and UAE being set up, and new competition outside the region taking shape.

But petrochemical companies in Saudia Arabia and other Gulf countries are still looking for possible acqusitions in China and India even in the wake of a global financial crisis. Saudi Arabia Basic Industries Corporation (Sabic) had earlier announced its desire to build a petrochemicals plant in India. While there has been no update on that plan, it was reported that Gas Authority of India Limited (Gail) and Reliance Industries Limited (Ril) have signified their interests to enter into partnerships with three GCC countries like the UAE, Saudi Arabia and Qatar. On the other hand, Sabic and the Chinese petrochemical

Mercurial Superfly CR7 High The falling oil prices have affected major oil producing countries in the Middle East to the extent of slowing down major infrastructure and industrial projects. Oil producers in the region are helpless in the wake of rapid price decline and have called for closer cooperation to stabilize crude prices. It has been reported that a number of upstream and downstream projects have already been postponed or cancelled and with the United States still in recession, demand for oil is not like to pick up substantially in early 2009. A combination of declining oil prices, lower crude demand and production cuts will cost the Organization of Petroleum Exporting Countries (OPEC) another $151 billion in lost oil export revenues this year, according to the US Energy Information Administration (EIA). The EIA has revised its monthly forecast for OPEC''s oil export revenue this year by 25% to $444 billion, which would be the lowest level since 2004. OPEC members, led by Saudi Arabia, are pushing for substantial reduction in crude output volumes to stem the rapid price decrease. Even with the anticipated budget deficits this year that Saudi Arabia and other Gulf oil producers are like to experience, the huge surpluses accumulated during the six years of high oil prices are expected to support government spending in the years to come. Governments in the Gulf region are seen to continuously pour billions into developing financial centers, setting up tourist spots, building up industry and petrochemicals and speeding up construction projects. There may be some slow down but the Middle East region is expected to sustain its high spending in these areas. "Saudi Arabia is the world''s largest producer and exporter of total petroleum liquids" With Saudi Arabia committing to spend $400 billion on development and investment in the next five years, the industries in the region remain optimistic. With an oil-based economy, Saudi Arabia posesses more than 20% of the world''s oil reserves and currently ranks as the largest exporter of crude oil in the world. The sector contributes to about 75% of the government''s revenues and 45% of the gross domestic production. About 90% of export earnings come from oil. Diversification as strategy The past few years saw high oil prices and this provided an impetus for economic growth. Revenues from oil helped the government explore other opportunities and encouraged expansion in such sectors as power generation, telecommunications, natural gas exploration, and petrochemicals. The government has targeted to reduce the kingdom''s dependence on oil exports, and industry diversification has been seen as the most ideal move. While economic uncertainty currently deters petrochemicals producers from pursuing their expansion plans, the slack may not be long term. Last year, when oil hit $150 a barrel, Gulf producers were pumping out large volumes of base polymer products almost regardless of the price they were fetching, now they have to slow down production due to sluggish demand and low prices. However, the industry players are taking a long-term view of the situation especially with new plants in Saudi Arabia, Qatar and UAE being set up, and new competition outside the region taking shape.

The falling oil prices have affected major oil producing countries in the Middle East to the extent of slowing down major infrastructure and industrial projects. Oil producers in the region are helpless in the wake of rapid price decline and have called for closer cooperation to stabilize crude prices. It has been reported that a number of upstream and downstream projects have already been postponed or cancelled and with the United States still in recession, demand for oil is not like to pick up substantially in early 2009. A combination of declining oil prices, lower crude demand and production cuts will cost the Organization of Petroleum Exporting Countries (OPEC) another $151 billion in lost oil export revenues this year, according to the US Energy Information Administration (EIA). The EIA has revised its monthly forecast for OPEC''s oil export revenue this year by 25% to $444 billion, which would be the lowest level since 2004. OPEC members, led by Saudi Arabia, are pushing for substantial reduction in crude output volumes to stem the rapid price decrease. Even with the anticipated budget deficits this year that Saudi Arabia and other Gulf oil producers are like to experience, the huge surpluses accumulated during the six years of high oil prices are expected to support government spending in the years to come. Governments in the Gulf region are seen to continuously pour billions into developing financial centers, setting up tourist spots, building up industry and petrochemicals and speeding up construction projects. There may be some slow down but the Middle East region is expected to sustain its high spending in these areas. "Saudi Arabia is the world''s largest producer and exporter of total petroleum liquids" With Saudi Arabia committing to spend $400 billion on development and investment in the next five years, the industries in the region remain optimistic. With an oil-based economy, Saudi Arabia posesses more than 20% of the world''s oil reserves and currently ranks as the largest exporter of crude oil in the world. The sector contributes to about 75% of the government''s revenues and 45% of the gross domestic production. About 90% of export earnings come from oil. Diversification as strategy The past few years saw high oil prices and this provided an impetus for economic growth. Revenues from oil helped the government explore other opportunities and encouraged expansion in such sectors as power generation, telecommunications, natural gas exploration, and petrochemicals. The government has targeted to reduce the kingdom''s dependence on oil exports, and industry diversification has been seen as the most ideal move. While economic uncertainty currently deters petrochemicals producers from pursuing their expansion plans, the slack may not be long term. Last year, when oil hit $150 a barrel, Gulf producers were pumping out large volumes of base polymer products almost regardless of the price they were fetching, now they have to slow down production due to sluggish demand and low prices. However, the industry players are taking a long-term view of the situation especially with new plants in Saudi Arabia, Qatar and UAE being set up, and new competition outside the region taking shape.  But petrochemical companies in Saudia Arabia and other Gulf countries are still looking for possible acqusitions in China and India even in the wake of a global financial crisis. Saudi Arabia Basic Industries Corporation (Sabic) had earlier announced its desire to build a petrochemicals plant in India. While there has been no update on that plan, it was reported that Gas Authority of India Limited (Gail) and Reliance Industries Limited (Ril) have signified their interests to enter into partnerships with three GCC countries like the UAE, Saudi Arabia and Qatar. On the other hand, Sabic and the Chinese petrochemicalMercurial Superfly CR7 High

But petrochemical companies in Saudia Arabia and other Gulf countries are still looking for possible acqusitions in China and India even in the wake of a global financial crisis. Saudi Arabia Basic Industries Corporation (Sabic) had earlier announced its desire to build a petrochemicals plant in India. While there has been no update on that plan, it was reported that Gas Authority of India Limited (Gail) and Reliance Industries Limited (Ril) have signified their interests to enter into partnerships with three GCC countries like the UAE, Saudi Arabia and Qatar. On the other hand, Sabic and the Chinese petrochemicalMercurial Superfly CR7 High