Italy is one of the most important players on the world market for machine tools. The number of EMO exhibitors from the southern neighbor is correspondingly high: Almost 200 companies are currently registered. This is the third largest group of exhibitors after Germany and China. But what about the Italian machine tool industry?

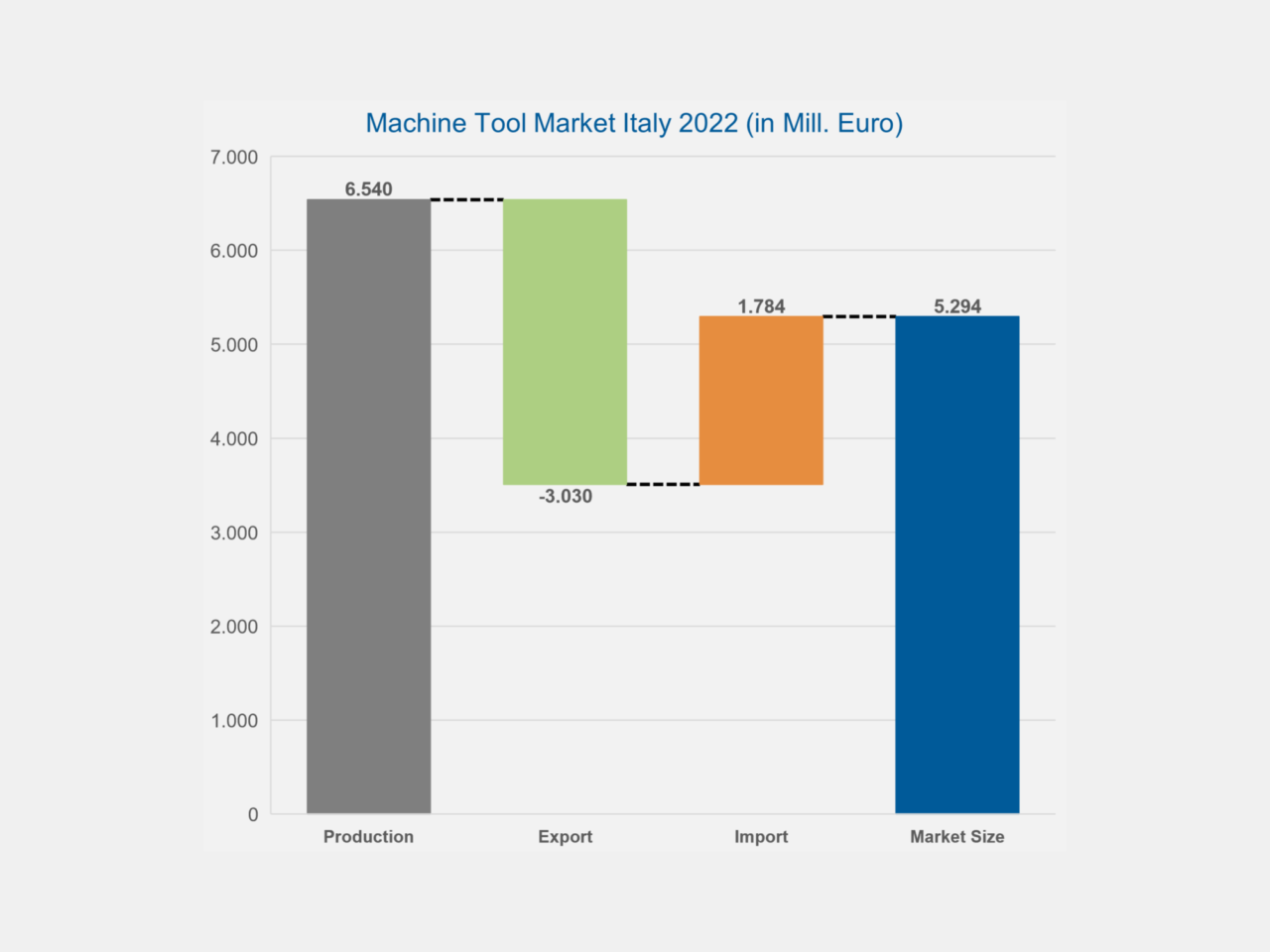

With a market volume of 5.3 billion euros 2022 count, the country has also overtaken Germany for the first time and now ranks third worldwide in terms of consumption. The country's own production is the second highest in Europe and about half is destined for sale abroad. When it comes to imports, Italian companies rely mainly on machine tools "Made in Germany". Around a quarter of all imports came from German companies.

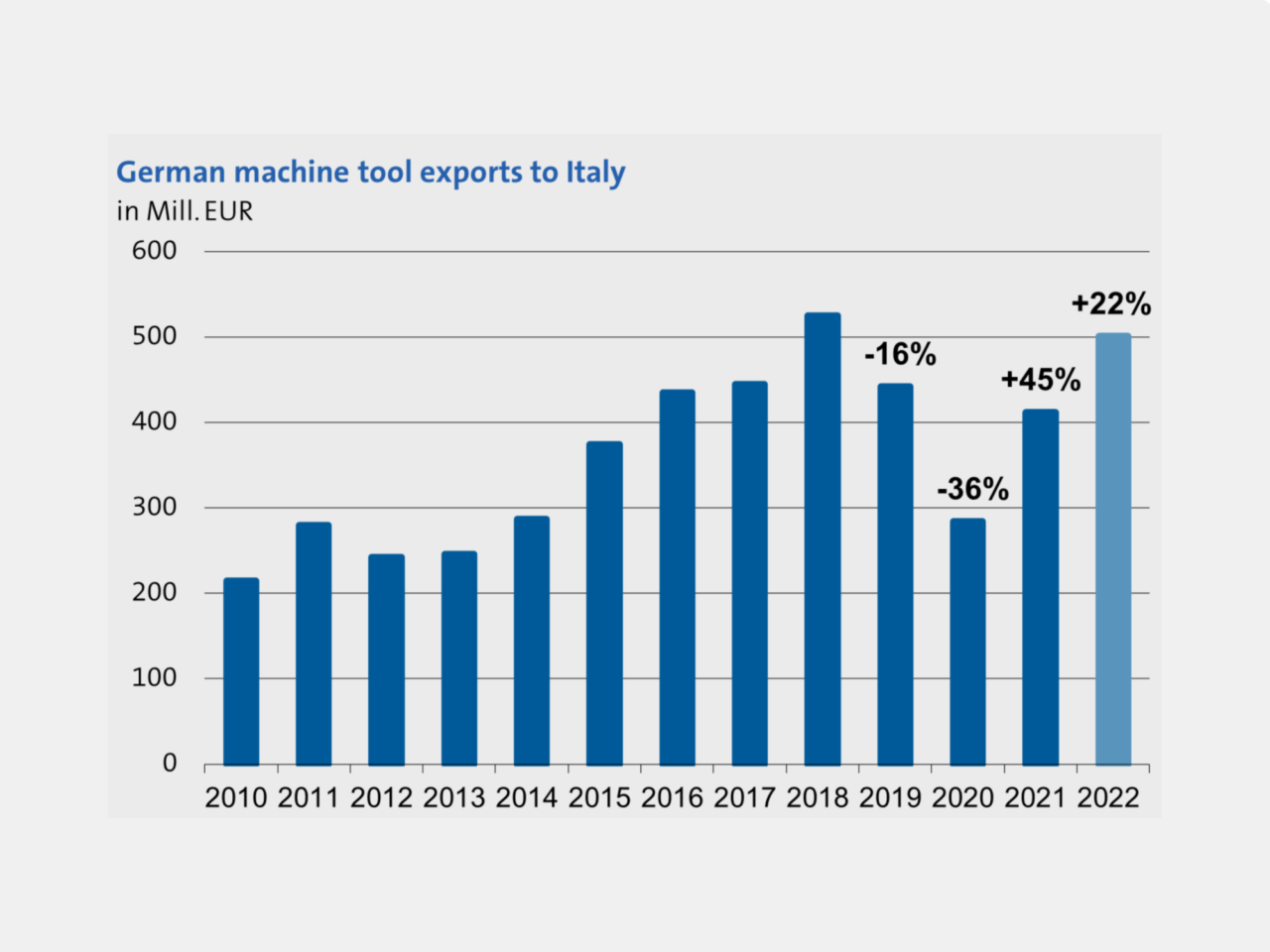

The German machine tool industry exported machines (excluding parts and services) worth just over 500 million euros to Italy in 2022. This corresponds to an increase in export value of 22 percent compared to the same period of the previous year.

In the ranking of the most important customer countries, Italy continues to occupy third place after China and the USA. Around 7 percent of all German machine tool exports went to the southern European country last year.

Production

Italy is the world's fourth-largest manufacturer of machine tools and the second-largest production location in Europe after Germany. The country produced machines with a total value of 6.5 billion euros in 2022 (up 15 percent on the previous year). This means that one in twelve machine tools in 2022 (world production in 2022: 80.3 billion euros) was built by an Italian company.

The Italians are particularly strong in the manufacture of forming and cutting machine tools. The share of this technology sector in production value is above average at 48 percent (approx. 3.12 billion euros) (world average: 29 percent). Metal cutting technology accounts for 3.4 billion euros (52 percent of production).

Export

The Italian machine tool industry is very strongly focused on foreign trade. The export volume in 2022 was around 3.03 billion euros (2 percent more than in the previous year). This means that almost half of domestic production was destined for sale abroad. The main destinations for Italian exports last year were the USA (451 million euros, share: 15 percent), Germany (299 million euros, 10 percent) and China (226 million euros, 8 percent).

Import

In turn, Italian companies imported machine tools with a total value of 1.8 billion euros in 2022 (38 percent more than in the previous year). In terms of imports, Germany is the most important trading partner with an value of 463 million euros and an import share of 26 percent, ahead of Belgium (11 percent), South Korea (10 percent) and Japan (9 percent).

Market volume

The total volume of the Italian machine tool market in 2022 was around 5.3 billion euros (up 32 percent), making it the third largest in the world, ahead of Germany. In terms of individual machine groups, the market for bending, folding and straightening machines (approx. €1.2 billion) was the largest. This was followed by lathes and turning centers (approx. 722 million euros) and machining centers (approx. 676 million euros).

iConnectHub

iConnectHub

Login/Register

Login/Register Supplier Login

Supplier Login