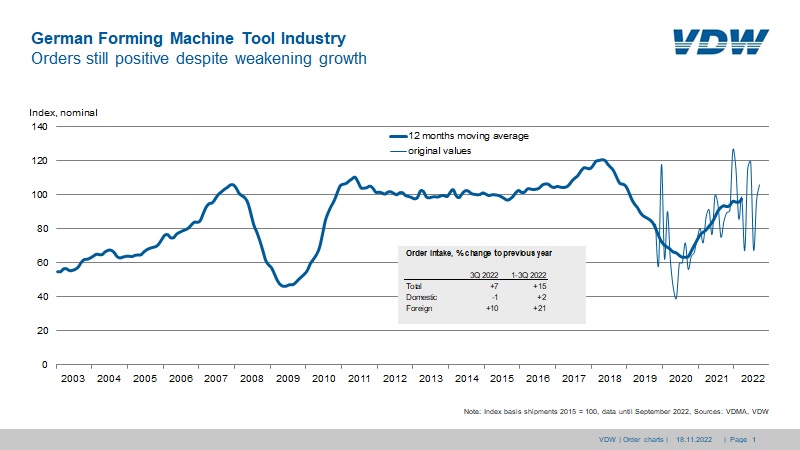

Order bookings by the German metal forming sector

Orders received by the German metal forming technology sector in the third quarter of 2022 were 7 percent up on the previous year. Orders from Germany fell by 1 percent whereas those from abroad were up by 10 percent. Demand rose by 15 percent in the first nine months of 2022. Domestic sales were up 2 percent while foreign sales rose by 21 percent.

"Orders in our sector have held up well so far, despite all the adverse factors. Although the growth is clearly slowing, both September and the third quarter as a whole are positive," says Dr. Wilfried Schäfer, Executive Director of the VDW (German Machine Tool Builders' Association), Frankfurt am Main, commenting on the result. However, producer prices in the machine tool industry rose 8 percent in the third quarter. On a price-adjusted basis, earnings will be slightly lower as a result. The forming and machining sectors have diverged recently. Machining grew twice as strongly as forming in the first three quarters of the year. Domestic customers are also still investing in machining equipment, with a two-digit increase posted here, while forming, which is predominantly project-based, is only showing a nominal 2 percent increase.

At the same time, capacity utilization in the metal forming sector rose to 94.3 percent in October this year. “However, sales are down 6 percent in the first three quarters of the year. This is explained in part by the supply bottlenecks, but also by the strong base from the previous year. In 2021, sales had grown by a sizable twenty percent," explains Schäfer.

The machine tool industry overall expects to see orders cool noticeably in the fourth quarter. Germany and Europe in particular are lagging behind, while Asia and America, which have been little affected by the energy crisis, are expected to perform more solidly. "Nevertheless, we will finish the year with overall growth in production," says Schäfer, summarizing the outlook. The sizable backlog will ensure that production remains high, as it takes time to process the orders, he explains.

Background

The German machine tool industry ranks among the five largest specialist groupings in the mechanical engineering sector. It provides production technology for metalworking applications in all branches of industry, and makes a crucial contribution towards innovation and enhanced productivity in the industrial sector as a whole. Due to its absolutely key role for industrial production, its development is an important indicator for the economic dynamism of the industrial sector as such. In 2021, with an average of 64,900 employees (firms with more than 50 staff), the sector produced machines and services worth around 12.7 billion euros.

iConnectHub

iConnectHub

Login/Register

Login/Register Supplier Login

Supplier Login