Greying consumers present both opportunities and challenges, report market analysts Euromonitor International

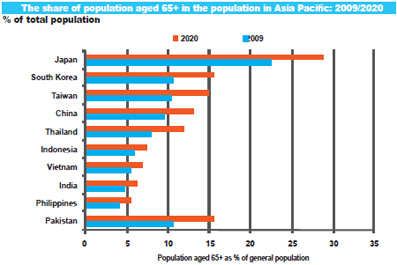

MORE than half of the world's elderly population lived in Asia Pacific in 2009, when 278 million people aged 65+ resided in the region - representing 52.4% of the world's 65+ population - compared to 207 million in 2000. Falling mortality and fertility rates, together with increasing life expectancies have pushed the share of 65+ year olds in the region's population up from 6.0% to 7.3% over the same period. Japan is the most aged society, not only in the region but also worldwide: 65+ year olds made up 22.7% of the island nation's population in 2009. Due to a low birth rate, Japan's ageing index - the ratio of 65+ year olds to children under 15 years old - stood in 2009 at 169.8%, compared with 110.6% in the European Union. A growing number of East Asian economies have crossed the "aged society" threshold* of a 7.0% share of the population aged 65+. These include advanced economies such as South Korea, with 10.7% of the population over the age of 65 in 2009, and Taiwan (10.4%) but also emerging economies such as China (9.6%), Thailand (8.0%) and Sri Lanka (7.5%). China's rapid ageing is unusual for a developing country and is due to its one-child policy, which since 1979 has discouraged couples in urban and some rural areas from having more than one child. Ageing is less advanced in India, Pakistan and Bangladesh, as well as Malaysia and the Philippines. In these economies, the share of 65+ year olds stood below 5.0% in 2009. Nevertheless, the numbers of the elderly are rising fast. The total number of 80+ year olds in those five countries has risen between 2000 and 2009, from 6.7 million to 10.0 million. Challenges and opportunities Rapidly ageing populations in the region's advanced and emerging economies, notably China, create opportunities for marketers of consumer goods and services. For emerging economies, however, ageing presents the challenge of upgrading healthcare and pensions systems, while maintaining economic growth with an older workforce. The healthcare and pension system in emerging Asian economies is woefully inadequate. According to a 2009 study by Oxford University, 700 million people in India had no access to health specialists. Planned public investments in these sectors will increase the fiscal burden of social services but could boost the spending power of the elderly and their families. At the same time, an ageing workforce is a challenge for emerging economies. Slowing growth of the workforce could lead to more sluggish economic growth. This is a concern for China, where in 2009, half the population was older than 38, compared to India, Malaysia, Pakistan and the Philippines, where more than half the population was under the age of 25. However, older workers have more work experience and knowledge, which can prove useful in the work place. Greying consumers Asia's greying consumers present opportunities for marketers of health-oriented consumer goods services and other sectors such as leisure products; however, marketers face the challenge of changing consumption patterns as older consumers tend to spend less than younger ones. One reason for older consumers in emerging economies to save more is the weakness of public health systems. With limited or no medical insurance, ageing consumers and their families save in order to ensure they can afford medical bills if necessary. This is one factor explaining the high savings ratio in China at 31.6% of disposable income, compared with only 12.6% in Taiwan in 2008. Taiwan, unlike China, has a national healthcare system with universal coverage. The spending potential of Asia's old consumers is enormous because of the tendency of Asian consumers to save, reflecteAir Force 1 Foamposite

Greying consumers Asia's greying consumers present opportunities for marketers of health-oriented consumer goods services and other sectors such as leisure products; however, marketers face the challenge of changing consumption patterns as older consumers tend to spend less than younger ones. One reason for older consumers in emerging economies to save more is the weakness of public health systems. With limited or no medical insurance, ageing consumers and their families save in order to ensure they can afford medical bills if necessary. This is one factor explaining the high savings ratio in China at 31.6% of disposable income, compared with only 12.6% in Taiwan in 2008. Taiwan, unlike China, has a national healthcare system with universal coverage. The spending potential of Asia's old consumers is enormous because of the tendency of Asian consumers to save, reflecteAir Force 1 Foamposite

iConnectHub

iConnectHub

Login/Register

Login/Register Supplier Login

Supplier Login