Increasingly hectic lifestyles mean consumers are looking for a boost to take them through the day, reports Datamonitor

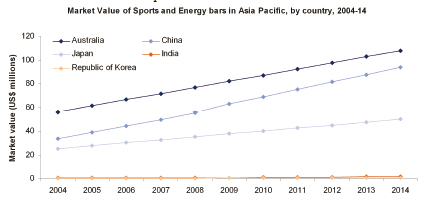

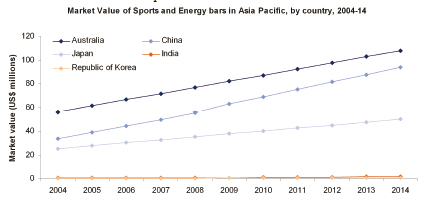

NUTRITION and energy bars are a growing market in many parts of the Asia Pacific region. In Australia for example, the market for sports and energy bars is expected to grow 5.5% to 2014. Growth forecasts are even higher in China, where the category is expected to enjoy 8.1% growth over the next four years. However, the country in which growth will be most profound is India, which is forecast to grow 15.5% to 2014. This growth will occur off a much smaller base i.e. US$0.9 million in 2009, compared to China at US$62.7 million in the same year (Figure 1). Within the Chinese market, sports and energy bars are expected to enjoy higher growth than other types of cereal bars, such as muesli bars or fruit bars for example. Datamonitor's Market Data Analytics predicts sports and energy bars to reach US$93.9 million in 2014 ?double that of granola/muesli bars. There are several reasons for growing interest in nutrition and energy bars. Consumers in Asia are living an increasingly hectic lifestyle, which is taking its toll on daily energy levels. Accordingly, they are looking for products that can assist them in boosting their energy to get them through the day. Datamonitor's Consumer Survey conducted in April/May 2009 found that food products that provide added energy are particularly appealing for consumers. In fact, 88% of Chinese consumers said they were interested in food and beverages that improved their physical energy or stamina; this was even higher than the global average of 79% (Figure 2). Furthermore, over one-third (35%) of Chinese respondents said that not only were they interested in such products, but they were actively buying them as well. It is important to note however, that there are 54% of Chinese consumers who are interested but not actively buying foods that improve their physical energy. This suggests that perhaps consumers are not entirely convinced that such products deliver on their claims, and that manufacturers need to build credibility in order to capitalise on this lucrative space. Nutrition and energy bars also benefit from their convenience and portability, which consumers increasingly value in their multi-tasking lifestyles. Indeed, many consumers in the region are skipping meals with more frequency, and require timesaving solutions to meal consumption. Datamonitor's August 2008 Consumer Survey offered more insight here: two thirds (66%) of Chinese consumers said they had sought food and drinks which are both convenient and healthy either 'more' or 'significantly more' in the past six months. Again, Chinese responses were even higher than the global average of 41%. Ingredient trends in nutrient bars An analysis of the latest cereal bar product launches in the Asia- Pacific region reveals the most pertinent ingredient trends for this category. In 2009, the most common product claim for new cereal bars was 'no artificial colour', illustrating consumers' increasing concern over products containing synthetic ingredients. Indeed, Datamonitor's Consumer Insight survey in April/May 2009 found that 59% of Chinese consumers are highly influenced (i.e. 'high' or 'very high' amount of influence) by food and beverage products that make the claim of 'no artificial additives'. Accordingly, the claims of 'no artificial flavour' and 'no preservatives' are also 3rd and 5th respectively in the top cereal bar claims of 2009.

Clearly, consumers are seeking products that are free from artificial ingredients, to allay any fears that such ingredients can have a negative impact on their health. The second most common claim for this category was 'high fibre', reflecting the growing trend of 'positive nutrition', whereby consumers are increasingly concerned abo

Nike Air Max NUTRITION and energy bars are a growing market in many parts of the Asia Pacific region. In Australia for example, the market for sports and energy bars is expected to grow 5.5% to 2014. Growth forecasts are even higher in China, where the category is expected to enjoy 8.1% growth over the next four years. However, the country in which growth will be most profound is India, which is forecast to grow 15.5% to 2014. This growth will occur off a much smaller base i.e. US$0.9 million in 2009, compared to China at US$62.7 million in the same year (Figure 1). Within the Chinese market, sports and energy bars are expected to enjoy higher growth than other types of cereal bars, such as muesli bars or fruit bars for example. Datamonitor's Market Data Analytics predicts sports and energy bars to reach US$93.9 million in 2014 ?double that of granola/muesli bars. There are several reasons for growing interest in nutrition and energy bars. Consumers in Asia are living an increasingly hectic lifestyle, which is taking its toll on daily energy levels. Accordingly, they are looking for products that can assist them in boosting their energy to get them through the day. Datamonitor's Consumer Survey conducted in April/May 2009 found that food products that provide added energy are particularly appealing for consumers. In fact, 88% of Chinese consumers said they were interested in food and beverages that improved their physical energy or stamina; this was even higher than the global average of 79% (Figure 2). Furthermore, over one-third (35%) of Chinese respondents said that not only were they interested in such products, but they were actively buying them as well. It is important to note however, that there are 54% of Chinese consumers who are interested but not actively buying foods that improve their physical energy. This suggests that perhaps consumers are not entirely convinced that such products deliver on their claims, and that manufacturers need to build credibility in order to capitalise on this lucrative space. Nutrition and energy bars also benefit from their convenience and portability, which consumers increasingly value in their multi-tasking lifestyles. Indeed, many consumers in the region are skipping meals with more frequency, and require timesaving solutions to meal consumption. Datamonitor's August 2008 Consumer Survey offered more insight here: two thirds (66%) of Chinese consumers said they had sought food and drinks which are both convenient and healthy either 'more' or 'significantly more' in the past six months. Again, Chinese responses were even higher than the global average of 41%. Ingredient trends in nutrient bars An analysis of the latest cereal bar product launches in the Asia- Pacific region reveals the most pertinent ingredient trends for this category. In 2009, the most common product claim for new cereal bars was 'no artificial colour', illustrating consumers' increasing concern over products containing synthetic ingredients. Indeed, Datamonitor's Consumer Insight survey in April/May 2009 found that 59% of Chinese consumers are highly influenced (i.e. 'high' or 'very high' amount of influence) by food and beverage products that make the claim of 'no artificial additives'. Accordingly, the claims of 'no artificial flavour' and 'no preservatives' are also 3rd and 5th respectively in the top cereal bar claims of 2009.

NUTRITION and energy bars are a growing market in many parts of the Asia Pacific region. In Australia for example, the market for sports and energy bars is expected to grow 5.5% to 2014. Growth forecasts are even higher in China, where the category is expected to enjoy 8.1% growth over the next four years. However, the country in which growth will be most profound is India, which is forecast to grow 15.5% to 2014. This growth will occur off a much smaller base i.e. US$0.9 million in 2009, compared to China at US$62.7 million in the same year (Figure 1). Within the Chinese market, sports and energy bars are expected to enjoy higher growth than other types of cereal bars, such as muesli bars or fruit bars for example. Datamonitor's Market Data Analytics predicts sports and energy bars to reach US$93.9 million in 2014 ?double that of granola/muesli bars. There are several reasons for growing interest in nutrition and energy bars. Consumers in Asia are living an increasingly hectic lifestyle, which is taking its toll on daily energy levels. Accordingly, they are looking for products that can assist them in boosting their energy to get them through the day. Datamonitor's Consumer Survey conducted in April/May 2009 found that food products that provide added energy are particularly appealing for consumers. In fact, 88% of Chinese consumers said they were interested in food and beverages that improved their physical energy or stamina; this was even higher than the global average of 79% (Figure 2). Furthermore, over one-third (35%) of Chinese respondents said that not only were they interested in such products, but they were actively buying them as well. It is important to note however, that there are 54% of Chinese consumers who are interested but not actively buying foods that improve their physical energy. This suggests that perhaps consumers are not entirely convinced that such products deliver on their claims, and that manufacturers need to build credibility in order to capitalise on this lucrative space. Nutrition and energy bars also benefit from their convenience and portability, which consumers increasingly value in their multi-tasking lifestyles. Indeed, many consumers in the region are skipping meals with more frequency, and require timesaving solutions to meal consumption. Datamonitor's August 2008 Consumer Survey offered more insight here: two thirds (66%) of Chinese consumers said they had sought food and drinks which are both convenient and healthy either 'more' or 'significantly more' in the past six months. Again, Chinese responses were even higher than the global average of 41%. Ingredient trends in nutrient bars An analysis of the latest cereal bar product launches in the Asia- Pacific region reveals the most pertinent ingredient trends for this category. In 2009, the most common product claim for new cereal bars was 'no artificial colour', illustrating consumers' increasing concern over products containing synthetic ingredients. Indeed, Datamonitor's Consumer Insight survey in April/May 2009 found that 59% of Chinese consumers are highly influenced (i.e. 'high' or 'very high' amount of influence) by food and beverage products that make the claim of 'no artificial additives'. Accordingly, the claims of 'no artificial flavour' and 'no preservatives' are also 3rd and 5th respectively in the top cereal bar claims of 2009.  Clearly, consumers are seeking products that are free from artificial ingredients, to allay any fears that such ingredients can have a negative impact on their health. The second most common claim for this category was 'high fibre', reflecting the growing trend of 'positive nutrition', whereby consumers are increasingly concerned aboNike Air Max

Clearly, consumers are seeking products that are free from artificial ingredients, to allay any fears that such ingredients can have a negative impact on their health. The second most common claim for this category was 'high fibre', reflecting the growing trend of 'positive nutrition', whereby consumers are increasingly concerned aboNike Air Max

iConnectHub

iConnectHub

Login/Register

Login/Register Supplier Login

Supplier Login