THE MARKET for in-mold labeling (IML), the process of applying labels to product containers or bottles during manufacturing, continues to grow. Industry experts project last year’s global volume of 925 million square meters to grow at an annual rate of 3%. This pegs projection at 1.01 billion square meters by 2017.

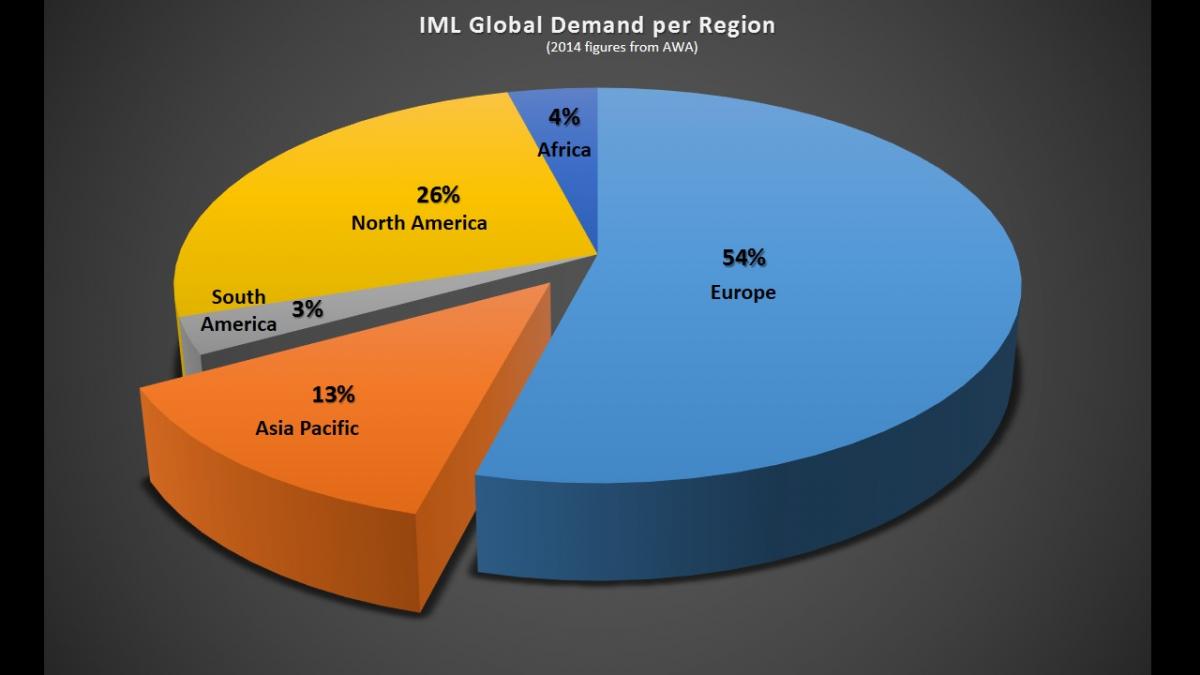

According Alexander Watson Associates (AWA), Europe had the largest global demand in 2014 at 54%. North America was second at 26%, Asia Pacific at 13%, Africa at 4% and South America at 3%. Given the technology’s high penetration levels in Europe, growth in the area is expected to continue at a much lower rate at 1.8%. In stark contrast, North America’s IML is projected to grow yearly at about 5.1%. Driving demand in the region are big brand promotions, new IML functions, new brands coming into the market, new product segments and even an increase in popular consumer items.

Source: Alexander Watson Associates

Currently, IML is done in four main formats. IML-Blowmold (BM) and IML-Extrusion Blowmold (EB) are typically used on bottles, while IML-Injection Mold (IM) and IML-Thermoform (TF) are generally used for open-top containers.

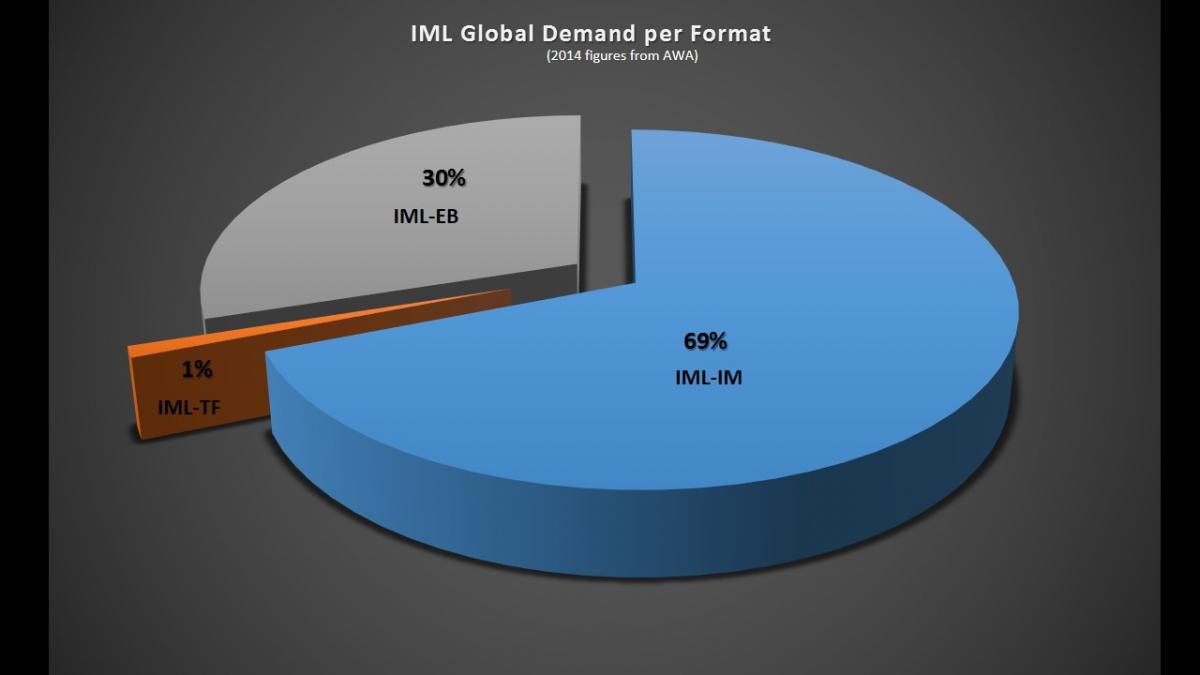

IML-IM led global demand in 2014 at 69%, followed by IML-EB at 30% and IML-TF at 1%. Both IML-EB and IML-IM are seeing modest growth in Europe in line with the region’s mature market profile. In North America IML-IM is enjoying high growth rates, while the IML extrusion blow market is stabilizing. Growth for both IML-IM and IML-EB are expected to be lower in Asia and in South America in 2014 compared to 2013. Prospects in Africa and the Middle East are promising with a forward-looking CAGR of close to 5%, which experts say is partly due to the low base.

Source: Alexander Watson Associates

The IML advantage

Industry insiders say the advantages of IML are clear. Aside from food product containers such as ice creams, yoghurts, sauces, butter, spreads, etc., IML is also ideal packaging for cosmetic and personal care products, petrochemical and paint, household products, and other molded plastic parts.

Distinct attributes of IML include permanency because labels become part of the wall of the container, making it non-peelable. In addition, the use of robotics in IML assures the accuracy of label placements and avoids missing stickers. And because the format provides remarkable flexibility, labels adapt to the container’s form and surface. This gives product designers more room to create standout brand labels.

As against the Cut & Stack method, IML does not require glue because the label is merged to the plastic container. So aside from improving the label’s shelf life, the plastic container is stronger and more appealing.

In competition with the Self-Adhesive Labels, IML’s seamlessly integrated packaging makes it resistant to environmental damage while preserving its print quality.

As opposed to Shrink Sleeve Labels, which demand specific design software and need secondary operations, IML saves on time and raw materials, making it more economical. Extra film material is needed in shrink sleeve labeling as compared to IML. In addition, if the sleeve and the bottle are not made of similar plastic material it becomes problematic when you intend to recycle. IML also significantly cuts the amount of waste when starting production lines.

Contrasted with Dry Offset, IML does away with some chemicals used by mold makers. In addition, 0-100% color gradation is achievable in IML versus Dry Offset’s 0-97%. In terms of lines per inch (LPI), IML can go 150 LPI compared with Dry Offset’s 80 LPI. It is also now possible to use smaller fonts, with IML achieving 6 pts minimum contrasted with Dry Offset’s 8 pts minimum.

Analysts say that as functionality and innovation increase, IML is expected to offer more solutions including using it for barrier packaging and providing greater sensorial appeal through textures, metallic looks and tactile labels.

Hurdling challenges

Despite being around for 20 years and its many outstanding benefits, IML remains in its infancy though, attracting only about 2% of the total label market.

In his keynote presentation at a recent conference in the US, AWA president and CEO Corey Reardon explained that one of the biggest hurdles for IML is the long, complex supply chain that often means greater up-front costs owing to the complex supply structure which includes the mold designer/mold maker, label maker, molder, resin supplier and customized automation supplier.

Others like plastic packaging company Alto though are not averse to making capital investments in the name of product improvement. Alto earlier set up a purpose-built manufacturing facility fully equipped with robotics and fully-guided facilities to produce Unilever’s Flora tubs.

Yet another major setback for the technology particularly for IML-BM is mass production and repurposing. Because blow molding factories are separate from product manufacturing plants, there are concerns from brand owners that manufacturers will order a large inventory of pre-labeled containers to match bulk orders from key retailers. Should the latter cancel or change, their orders, it will leave manufacturers with large quantities of pre-labeled, unusable containers. To prevent such risk and keep shortfalls to a minimum, many brand owners have resorted to late stage product differentiation methods.

Still, industry experts say IML has the upper hand in terms of getting the highest quality at the cheapest unit cost. Key retailers are reportedly convinced of this too and are pushing for IML and other durable and viable labeling systems.

Drivers of growth

A 2014 survey released by US-based In-Mold Decorating Association (IMDA) backs this observation.

Respondents have noted that more and more customers demand in-mold labeling and in-mold decorating services. A total of 38% said their customers require it, which is an improvement from 32% in a similar survey run in 2011. Meanwhile, 34% indicated that IML/IMD is a market differentiator, an increase from 32% in 2011. However, those who said that IML/IMD is a durable decorating method went down to 10% in 2014 from 14% in 2011.

Signifying a healthy growth in the industry, about 40.7% of the respondents indicated that their sales expanded by more than 10% while 27.8% reported 1 to 10% sales increase. Sixty one percent of respondents, meanwhile, noted increase in requests for quotes or proposals for future IML/IMD business.

Winning bets at IMDA Awards

In the 2014 IMDA Awards, IML used in food packaging figured prominently. Winning Gold for Best Part Design is KFC Go Cup. The innovative portable packaging had KFC’s brand precisely labeled across a halved cup that was small enough to fit in a car cup holder. The branding could be easily changed to accommodate promotional artwork.

Another KFC packaging bagged Gold for Best Thin Wall Package. Its 64 oz. IML Thin Recess Injection Molding (TRIM) Pail craftily decorated a wall thickness that was about half of what was possible with conventional thin-wall molding technology. The full wrap label maximized coverage of the container over a large surface area and made it possible to accommodate two brand messaging on opposite sides.

Gold Awardee for Best Product Family was Film Seal Round, used to re-launch Tre Stelle’s fresh cheeses as it moved from offset-printed containers to IML-decorated ones. It currently utilizes assorted colored lids to differentiate the products.

Also bagging Gold for Best Prototype Package is IPL SkinnyPack. Its thin but durable packaging technology combines flexible, printable film to a sturdy, rigid frame. Aside from producing attention-grabbing packaging, its use of thinner film also lends itself to greater eco-sustainability.

Sustainability of IML

Just how sustainable is IML? Quoted on IMDA’s website, executive director Ron Schultz summarizes it as requiring less use of energy, labor and non-renewable resources. He explains that in particular, IML does away with flame treaters and labeling machines needed post-mold as well as gas or electricity to power such machines. It does away with the gluing, making wet or hot melt glue unnecessary. This is because in-mold labels are in the wall of the container while others are glued on the outer surface of the container. This translates to 15% resin savings. On top of that, it allows the molder to light-weight container while at the same time reinforce its side walls. It follows, therefore, that even extra labor to operate labeling machines are eliminated, so is the extra floor space needed for the labeling machines. Space intended to store blank containers is also freed up because containers are produced and labeled in one single step. Release liners to recycle, incinerate or bury in a landfill also becomes unnecessary with IML. The unique feature of making the label and the container built of the same material makes IML containers 100% recyclable. No peeling of labels and scrubbing off of adhesives are required at the end of the products life and packages can go straight to recycling.

Nike Schuhe

iConnectHub

iConnectHub

Login/Register

Login/Register Supplier Login

Supplier Login