From indulgence to well-being, consumers expect to be delighted by the overall attributes of the confectionery and OTC sweets they purchase. Naturally the combination of good ingredients, formulation, and processing make for high-quality products. But as manufacturers report, the industry is also challenged by raw material supply and rising costs, and the pressure to take steps toward digitalisation and sustainability moving forward. This compels them to seek efficient solutions that can support their production plans. Fortunately, developments in the areas of depositing, mixing, moulding, tempering and other processes are quite extensive.

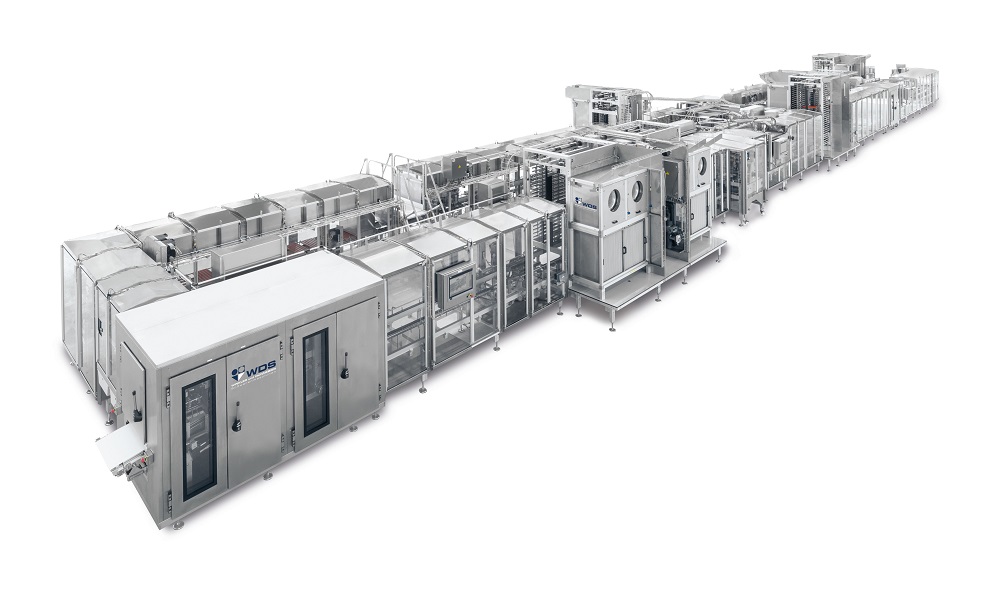

Sweets like jelly that can be made using WDS production lines (Photo: WDS)

According to Data Bridge Market Research, the global chocolate and confectionery processing equipment market was valued at USD3.4 billion in 2021; from there it estimates the market to reach USD 7.08 billion in value by 2029, with growth at a CAGR of 9.6% for the period between 2022 and 2029. The pandemic slowed growth especially in 2020, but the situation has dramatically changed.

Jessica Runkel, Managing Director of Winkler und Dünnebier Süßwarenmaschinen GmbH (WDS), said that the beginning of 2023 had already been auspicious since confectionery manufacturers began showing interest in machinery investment. Mrs Runkel who was appointed to her current position in 2021, expects a turnaround.

Companies that cater to confectionery makers understand the growing need for manufacturing flexibility, as well as versatility. As a global company, WDS is familiar with the requirements of most markets – whether in Europe or Asia. Based in Germany, WDS offers solutions for most areas of application including the wide spectrum of moulded sweets. Its expertise lies in developing lines for chocolate, gum, jelly, fondant, toffee and OTC sweets.

This expertise was showcased at interpack 2023, where a 650-square-metre multimedia stand became the “Home of Confectionery Diversity” – suitably housing WDS’ well-known as well as latest equipment and product lines for all capacity requirements. Versatility and future-proofing are key to WDS equipment, allowing its customers to increase their productivity in line with their business expansions.

WDS' ConfecPRO chocolate moulding plant is for depositing medium to high capacities of filled and solid chocolates.

The ConfecPRO chocolate moulding plant is an example of exquisite design from WDS. Made for depositing medium to high capacities of filled and solid chocolates, it is a modular and flexible production line, and as so, chocolate manufacturers can add more stations as their production increases. This also allows them to meet varying customer requirements with less effort. The ConfecPRO design also gives manufacturers the option to choose between one or two lanes, at ground level or over several floors, according to WDS. Meanwhile it is built for easy operation, from having a high-tech intuitive touch panel, to nozzle depositors that are simple to change.

Another concept that allows for future upgrades, the ConfecECO was configured for jelly production for interpack trade visitors. But make no mistake, this start-up line can handle the production of plain, center-filled bars, pralines and masses with inclusions, up to a capacity of about 600kg/h (depending on size and weight), according to WDS. There are three variants to the ConfecECO: the ConfecECO-D, ConfecECO-DC and ConfecECO-DCM, which vary in terms of automation and manual operation.

The ConfecVARIO is for producing chocolate with or without filling, as well as gum, jelly and OTC sweets, in one machine. It features a chainless drive system with switch technology that gives users more options for plant layouts and enables the production of various products and masses in different sections. Moulds can be moved individually and processes can also run in parallel. A special feature of this machine is the VarioCABINET multifunction chainless cabinet for cooling, heating and holding polycarbonate moulds.

These are but a few from the WDS portfolio. Manufacturers also need to know that WDS equipment allow them to comply with the strict regulations for chocolate production especially when it comes to food safety. The past few years have seen more stringent hygiene requirements in confectionery production and the surging popularity of validated plants for producing OTC sweets and supplements, according to WDS.

Staying relevant

No doubt there are confectionery or chocolates that have gone off the market for one reason or another. To remain competitive these times, manufacturers should be able to meet demand for personalised production.

WDS is able to support its clients in creating personalised chocolate, gum, jelly, toffee, fondant and hard candy. “We have customers who bought machines which make not only chocolates but also jellies, including those with vitamins or calcium as well as other special ingredients. This is a trend which offers for us new opportunities, new markets especially in the pharmaceutical industry,” Mrs Runkel said.

Individuality in planning and design is one of the company’s thrusts, making sure that clients can easily improve their products and services in line with changing market demands. - by Marijo Gonzalez

Growth for chocolate and confectioneryMarket research shows that while demand for healthy food and beverages increased at the height of the pandemic, consumers also sought indulgent products like mainstream chocolate as among their comfort foods. Proprietary research shared by Barry Callebaut forecasts the chocolate confectionery market to grow USD128 billion in retail sales in 2023. The Swiss company also broke down the latest chocolate trends into just three – intense indulgence, mindful indulgence, and healthy indulgence. Simply put, consumers want delicious and healthy chocolate, so this is where manufacturers need to concentrate their future innovations. In Southeast Asia, the confectionery market will generate 11.74 billion kg in volume by 2028. In 2024, volume growth will likely be at 6.7%, according to Statista. It also said the average volume per person in the confectionery market is 13.39kg in 2023. Promising market figures for the region's chocolate and confectionery remain attractive to processing equipment makers from across the globe. “Asia is an important market for us as it has a lot of potential,” said Jessica Runkel, Managing Director of WDS. She said the company is interested in further developing their presence in Asia and in improving relationships and connections with customers in the region.

|

Sources

Top chocolate trends for 2023 and beyond. https://www.barry-callebaut.com/en/manufacturers/trends-insights/top-chocolate-trends

Asia Pacific Cocoa and Chocolate Market to Hit USD 8,892.57 million by 2027 at a CAGR of 5.42% https://www.linkedin.com/pulse/asia-pacific-cocoa-chocolate-market-hit-usd-889257-million-coner/

Global Chocolate and Confectionery Processing Equipment Market – Industry Trends and Forecast to 2029

iConnectHub

iConnectHub

Login/Register

Login/Register Supplier Login

Supplier Login