Endoscopy is one of the great inventions in the medical field, allowing medical practitioners to carry out minimally invasive surgical procedure. The endoscopy market has been primarily driven by incremental innovations in the form of add-on feature as medical procedure demands it from time to time. Together with the design evolution comes an increase in the number of diagnostic and surgical procedures performed using endoscopy, thus becoming the main driver for the market growth.

What''s happening in Asia Pacific?

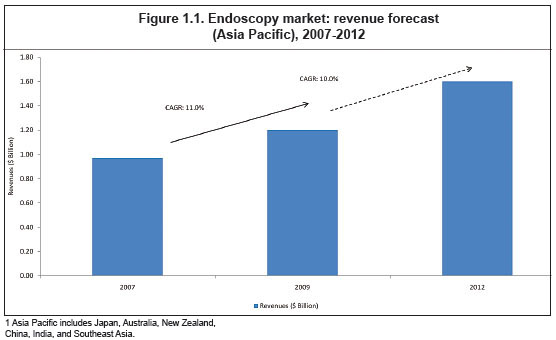

The Asia Pacific1 endoscopy market was valued at USD 1.2 billion in 2009. The market has been growing at a rate of 11% over the last 3 years since 2009 and is set to experience a compound annual growth rate (CAGR) of 10% from 2010 to 2012.

The demand for endoscopy systems in Asia Pacific is expected to remain strong over the next few years because hospitals in India, Southeast Asia, and China continue to purchase technology-intensive products as the increasing numbers of elderly patients in these countries require sophisticated medical procedures. Thus, leading endoscopy manufacturers in this market, such as Olympus Medical Systems, Karl Storz, Fujinon Corporation, Richard Wolf, and Hoya-Pentax, have already begun expanding into the emerging countries in Asia Pacific.

As the healthcare market progresses, four key growth factors will determine the expansion rate of the endoscopy market in Asia Pacific. The market will be driven by the increase of an aging population in Asia Pacific, increase of manufacturers leading to lower pricing, increased efficacy of usage, and reimbursement by insurance providers.

1. Growing Aging Population

Elderly patients often require extra medical attention and special sick care to accommodate to their physiology. Having been inflicted with one or more chronic diseases after the age of 65, invasive diagnostics and treatment may lead to procedural complications if an endoscopy system was not in place.

In 2010, 7.6% of the Asia Pacific population (approximately 240 million people) will be aged 65 and above, particularly in Japan, Australia, China, and Southeast Asia. By 2020, this will be more than 9.7%, with a total of 330 million people. About 65.2% of those aged 65 and above will have one or more chronic diseases.

Endoscopy system, through its minimally invasive surgical procedures, will improve the patient recovery cycle and, consequently, reduce the length of hospital stay. This will help hospitals, particularly those in densely populated countries in Asia Pacific, to reduce the number of beds or maintain the same to service a larger patient pool.

2. Competitive Pricing

As the demand for endoscopy procedure increases due to the growing aging population, more manufacturers will be attracted to this market, thus leading the industry into lowering its product pricing to survive. This will inevitably increase endoscopy technology adoption rate of healthcare providers within Asia Pacific, a market that is more price sensitive.

3. Increased Efficacy and Usage

The endoscopy procedures not only appeal to those above 65 but also to the younger age group. It is known that endoscopy has minimal risk and a higher survival rate compared with other surgical procedures. As the number of surgeries increases within the middle-class patients, even smaller private hospitals (with 300- 600 beds) will equip themselves with endoscopic equipment, thereby fuelling the market demand.

4. Reimbursement by Health Insurance Companies

Recent shift in policy within Asia Pacific, especially India, Malaysia, and Singapore, has increased Private Health InsuAir Max 2017

iConnectHub

iConnectHub

Login/Register

Login/Register Supplier Login

Supplier Login