AMI Consulting, a division of Applied Market Information Ltd., has released report on the heavy duty sack market, analyzing the latest trends in Europe in the use of polyethylene versus paper across the various end use sectors, along with developments in raw materials, extrusion technology and bagging equipment at the packing stage.

Heavy duty sacks are generally regarded as those that hold 25kg of product, although there are some exceptions. In 2010, plastic sacks overtook paper sacks in terms of number of units, since then plastic's share has grown to almost 55 percent and is forecast to rise to almost 60 percent by 2020. Sacks are a significant segment of polyethylene packaging in Europe, accounting for a little over 7 percent of total polyethylene film production.

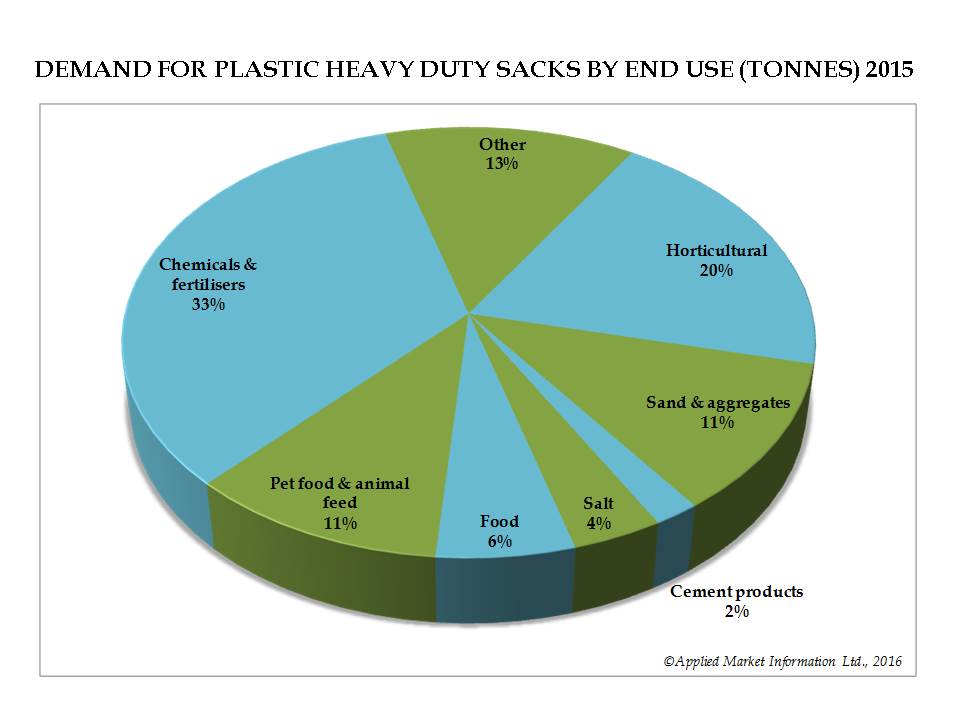

In 2015, food accounted for 6 percent of demand for plastic heavy duty sacks by end use (tonnes).

Food packing in plastic heavy duty sacks is a relatively fast-growing sector, driven by increasingly strict requirements on paper sacks in terms of food contact compliance and the risk of contamination by paper fibers.

The benefits of plastic

According to the report, plastic sacks are taking over for the following reasons: they show improved 'stackability' which reduces storage space and transport cost as opposed to, for example, stand-up paper or woven sacks; they are lighter than their paper alternative and so can dramatically reduce the carbon footprint of the packaging; plastic sacks are 100 percent recyclable as opposed to paper sacks laminated with a plastic liner and they demonstrate 100 percent sealability giving rise to dust-free handling with no spillage or waste; additionally barrier properties can be built into the base film where required, e.g. to improve odor or moisture barrier.

The plastic heavy duty sack sector has always made good use of newly developing raw materials: first butene linear resins, then the higher alpha olefins and, more recently, metallocenes to allow a continual process of product improvement and material downgauging. Major thickness reductions took place at the turn of the millennium then during the period 2006-2010, however further thickness reductions have continued to take place, but at a slower pace.

LDPE remains the major polymer used in the production of heavy duty sacks at a little over 50%, followed by HDPE/MDPE, butene, octene then metallocene. Bimodal HDPE and metallocene resin show the highest growth rates, although from a much lower base.

Advances in form-fill-seal (FFS) machinery will continue to create further opportunities for plastic industrial sacks to displace multi-wall paper sacks in their existing stronghold areas, such as food and pet/animal feed and non-food powder products like cement.

The plastic heavy duty sack market is fairly fragmented with a high number of producers. However, there are six major producers with a combined annual production of a little under 200,000 tonnes: Armando Alvarez Group, Bischof + Klein, British Polythene Industries, Nordfolien, Oerlemans Packaging and RKW.

For more information, download Heavy Duty Sacks Europe which complements a set of detailed market reports on industrial films published earlier this year by AMI Consulting which includes also Palletisation Films Europe and Collation Shrink Films Europe.

Vans Old Skool Grise

iConnectHub

iConnectHub

Login/Register

Login/Register Supplier Login

Supplier Login