The amount of Foreign Direct Investment (FDI) into Africa has increased significantly despite a decline in other emerging markets, to reach a level of US$46 billion in 2012. A large proportion of this investment has been directed at the mining sector in Africa due to the availability of resources in African countries.

Overview

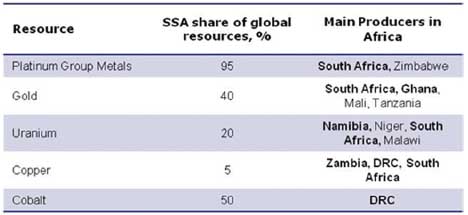

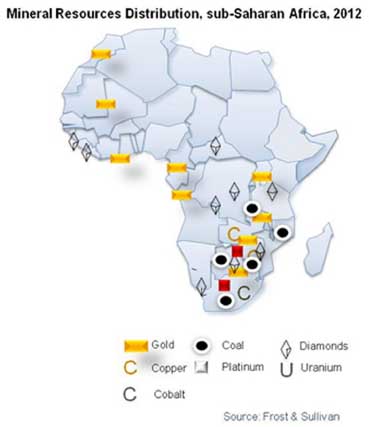

The Sub Saharan Africa region is richly endowed with mineral resources that include gold, copper, uranium, platinum group metals, diamonds, coal and iron ore. Eleven African countries are among the top ten resource rich economies in at least one major mineral. Copper and platinum group metals deposits are concentrated in Southern Africa while gold deposits are distributed across Southern, West and East Africa. Sub Saharan Africa hosts 95% of the world’s platinum group metal reserves.

Key producing countries and opportunities

The mining sector in sub-Saharan Africa is expected to remain strong and previously struggling economies such as the DRC are expected to boost their production output. In 2013, the copper output from the DRC increased by 52% year on year from 2012 and the upward trend in production is expected to continue in the short to medium term.

Some of the other countries that represent opportunities for mining include: copper and cobalt in Zambia; gold production in Ghana and Tanzania; uranium in Namibia and nickel in Madagascar. These countries represent opportunities for mining chemicals and explosive manufacturing companies to expand in Africa.

Customers

Key customers are often multinational mining companies with a presence in a number of African countries. The key requirement of these companies is good quality mining chemicals from reputable players and they often prefer African suppliers such as AEL, BME and Sasol over Asian suppliers that are perceived to provide sub-standard quality goods.

Competitors

AEL, BME and Sasol dominate the mining chemicals market in sub-Saharan Africa, with Orica being a global supplier that is starting to make in-roads into the African market. The competition from BME and Sasol is starting to tighten for AEL. The demand for mining explosives is expected to decrease in the medium term due to a drive toward alternatives to blasting. Refining and processing chemicals demand is also decreasing due to changes in technology that are reducing consumption, as well as due to alternative technologies such as High Pressure Acid Leaching and bioleaching.

Case Study: AECI

AEL has diversified away from the South African mining sector to reduce to impact of declining production output and uncertainty in the sector. AEL is building capacity in Ghana and Tanzania to service the West and East African mining sectors, as well as in DRC and Burkina Faso. Zambia, Namibia and Angola are mostly serviced from South Africa, although some mines have on site bulk emulsions plants such as Lumwana in Zambia. This indicates a clear strategy to derive greater benefit from the mining sector in other African geographies. As a result 50% of parent company, AECI, revenue is now derived from providing mining explosives and other chemicals outside of South Africa.

Conclusions

Untapped reserves, increased exploration, investment and increasing confidence in African economies means that Africa represents good opportunities for mining activities in the medium to longer term. The DRC especially represents a high growth market for mining of cobalt and, in the longer term, for potential beneficiation of its mineral resources.

AEL continued investment in mining explosives in African countries other than South Africa suggests that the short term expectation is for explosives usage to grow in other African geographies, while the future of a declining and unstable South African mining sector is considered uncertain.

Nike Jordan Superfly 2017

iConnectHub

iConnectHub

Login/Register

Login/Register Supplier Login

Supplier Login