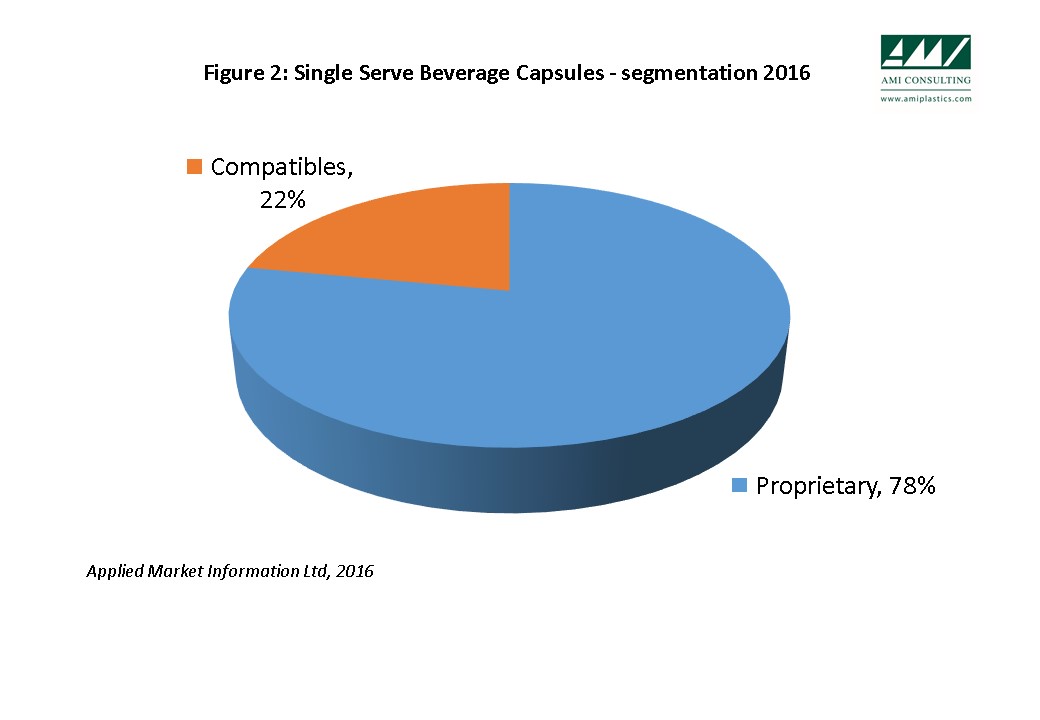

THE COMPATIBLE coffee capsules segment continues to grow, with plastic compatible capsules currently estimated at 22 percent of the global single-serve beverage capsules market in terms of unit volume. The increasing fragmentation in the coffee capsules market is expected to reshape the supply landscape and consumer choices.

A recently published comprehensive deep-dive analysis of the coffee capsules industry by AMI Consulting, in cooperation with Plastic Technologies Inc., reveals formerly dominant suppliers are losing their control as the supply chain shreds its oligopolistic nature. With the premium image of the industry changing, average prices have been declining, along with quality of some products based on OTR and brewing machine performance. Nestlé and its machine partners, in fact, faced operational challenges related to machine servicing and resultant increased service costs brought about by machine malfunction or misuse in correlation with compatibles.

The Nespresso system is currently the biggest selling system worldwide with ca.17 billion units, including aluminium capsules and plastic Nespresso compatibles. The influx of Keurig imitations in the North American market from 2012 onward is not as widespread compared with Nespresso.

New compatibles developments are more inclined toward the Nescafé Dolce Gusto system, another Nestlé brand. Dolce Gusto compatibles are expected to rise strongly in the next few years despite their currently low market penetration.

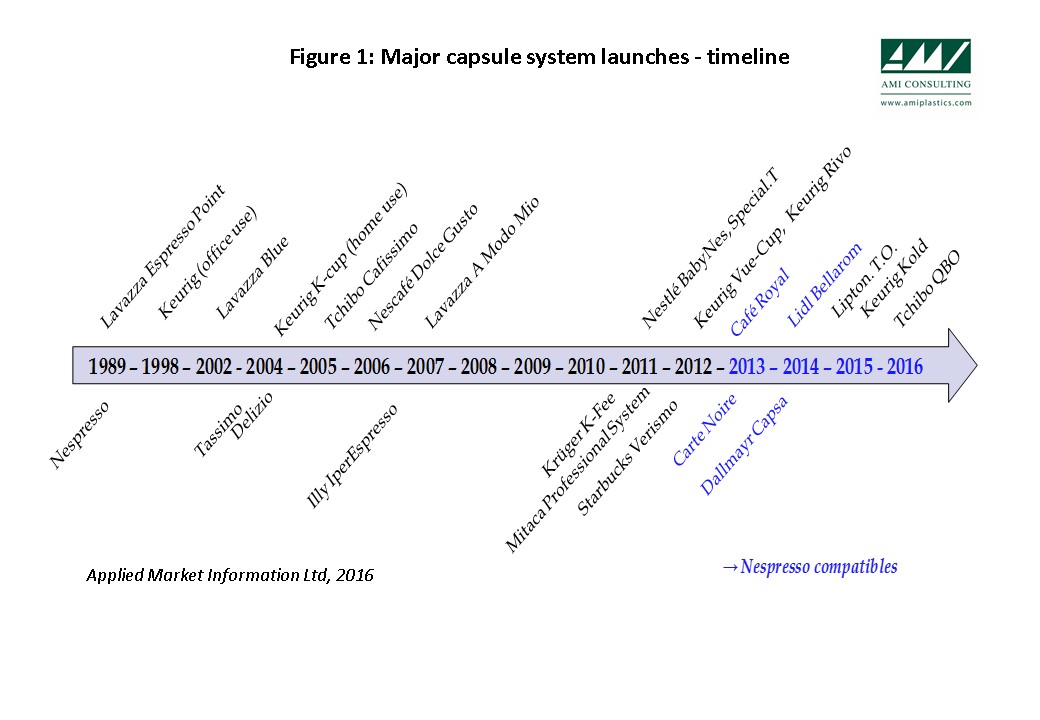

The capsules industry has evolved from an oligopolistic market in the mid to late 1990s into a complex value chain. The line was dominated by pioneers Nestlé (with Nespresso) and Keurig Green Mountain (with K-Cups), although there were a couple of Italy-centred systems such as the Lavazza Espresso Point for traditional espresso brewing. The growing popularity of the capsules format in 2000s gave rise to high-margin brands such as Dolce Gusto (by Nestlé), Tassimo (by Kraft, now Jacobs Douwe Egberts) and A Modo Mio (by Lavazza).

Legal circumstances, however, initiated major market changes in 2012. Nespresso and Keurig design patents expired that year, resulting in supply chain disruptions whilst opening opportunities for end-users and converters and lowering the entry barriers from both filling and moulding perspectives. These paved the way for the development of Nespresso-compatible brands and own-label products that can offer more competitive retail pricing whilst still relying on the Nespresso machines instalment base.

This report is aimed at assisting industry participants and investors in anticipating change, formulating response strategies, directing R&D investment, and proactively managing the threats. It analyses the global market opportunity and maps out the complex supply chain structure.

Off White X Vapormax Flair

iConnectHub

iConnectHub

Login/Register

Login/Register Supplier Login

Supplier Login