In Indonesia, marketing of various global brands of machine tools is predominantly handled by sole agents appointed by their principals. Prior to the 1990s, use of agents was required as a regulation and foreign companies were not allowed to operate in retail business. The same applied for even domestic producers of heavy equipment. During the 1990s, the government lifted this restriction and foreign companies were allowed to operate in distribution and retail trading. However, many companies still use local agents for marketing purposes. For instance, the sole agent for PT Komatsu Indonesia, and PT Hitachi Machine tools Indonesia are PT United Tractors, and PT Hexindo Adiperkasa respectively.

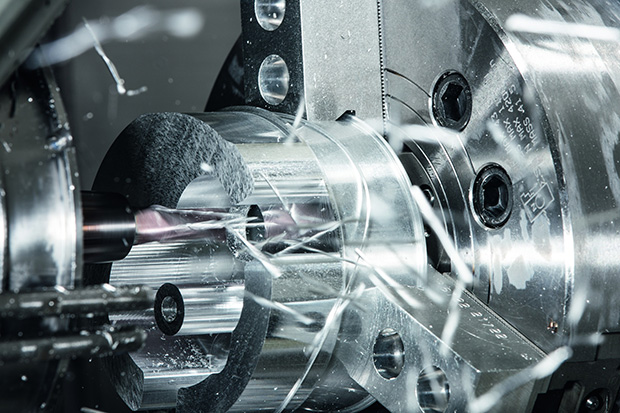

Photo courtesy of SolidCAM

Increased government spending

The market value of machine tools in Indonesia rose by 7% to US$85.6 million in 2012 from US$80 million in 2011. The increase was due to the operation of new factories in the country. Chairman of the Indonesian association of machine tool industries (Asimpi), Mr Dasep Ahmadi, said local producers rallied to supply most of machine tool requirement in the country. Around 50% of machine tool requirement of Japanese users in Indonesia, are supplied by local producers. Mr Dasep said local products have a 25% share of machine tool market in the country in volume but only 20% in value. He said the government policy of giving priority to local products would increase the market share of locally produced machine tools in the country. The government's spending on machine tools is estimated to average US$35 million a year between 2014-2017. Meanwhile, data at the industry ministry show that machineries and equipment are dominant in contribution to the country's trade deficit with Japan and South Korea. In the period of 2007-2011 Indonesia recorded a deficit of US$ 3.93 billion per year in machinery trade with Japan and US$530 million in trade with South Korea. Meanwhile, imports of machines and equipment from China increased 65% to US$ 4.95 billion in 2011 from US$3 billion in 2009.

Value chain

The value chain of machine tools in Indonesia begins with iron ores from where iron and steel (major part of the machinery) used for the parts of the machine tools are manufactured. Other components such as rubber, electronics form smaller proportion of the machine tools. Individual parts and components are either manufactured by local players or imported. The parts are then assembled either by the equipment manufacturers or by their sole agents and are available for retail sales.

End users

The growth of the machine tools and cutting tools market is powered by the individual growth of the mining, power generation, automobile, aerospace & defence industry. As the use of composite materials in automobile industry increases, diamond tipped tools will also grow faster vis-a-vis cemented carbide tools. Cement carbide tools are heavily used in the mining and power generation industry and steel and steel alloys are mostly used in fabrication of various components. Use of intricate components in aerospace & defence industry is expected to promote use of high precision tools. The machine tools market is expected to grow at 6.2% from 2014 to 2017. Machine tools import in automotive sector contributed 45% of the total import, while the remaining came from several other sectors such as oil and gas, or transportation. The majority of imported machine tools are from Japan and China.

Crazy BYW LVL Boost

iConnectHub

iConnectHub

Login/Register

Login/Register Supplier Login

Supplier Login