Europe's injection molding sector is recovering from the impact of the economic recession. According to a recent report by AMI Consulting, the value of the European plastics injection molding industry in 2014 was 11% higher than its pre-crisis value, although the volume of polymer processed was still about 7% lower than in 2007. Much of the value increase is associated with higher raw material costs but the industry has striven to maximise the potential of new and added value opportunities.

The packaging sector remains the largest injection molding market in terms of polymer volume consumed, particularly because it includes demand for PET preforms. The packaging sector is almost equally important across every country because it typically serves local consumer demand. By comparison the automotive market is the most valuable injection moulding sector and its demand is increasingly being focussed in countries retaining or attracting vehicle assembly. Within Europe the shift of molded volume from Western to Central and Eastern Europe has largely been a result of following the investment by customers, particularly the automotive and electrical appliance manufacturers. However, the economic development of these regions has also created a larger consumer market to the benefit of the whole moulding sector.

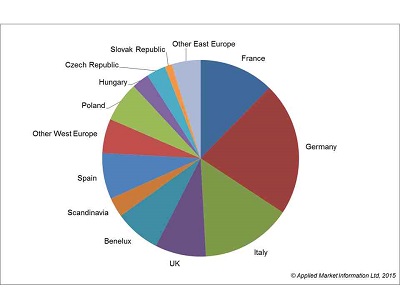

Injection molding polymer demand by country 2014

The global recession accelerated the process of rationalisation of the European injection molding industry that had been underway for several years, particularly in Western Europe. Using analysis of AMI's proprietary injection moulding database the report tracks the structural changes within the industry which is reported to involve more than 8,500 different companies across Europe. These range from small, family owned concerns up to multinational groups. The importance of molding to the overall business can also vary significantly hence a wide range of business models exist in the industry.

Western Europe has continued to experience most contraction with more than 2,000 moulding sites closing since 2007. In Central and Eastern Europe closures have been more than offset by new entrants: the region continues to attract a high level of new investment. The overall rate of decline in moulding sites is forecast to slow down but, through extrapolation from its database, AMI forecasts that Europe will lose a further 2% of its injection molding sites by 2018. However, polymer demand and industry value for injection moulded products is forecast to grow across almost every market sector. The higher demand will therefore be met by a smaller, yet more cost effective, strategically located supplier base.

iConnectHub

iConnectHub

Login/Register

Login/Register Supplier Login

Supplier Login