INCREMENTS in margins and steady growth helped to lift investment confidence in the BOPP film industry in 2015. While most major companies focused on China, they are now looking to advance manufacturing in Africa, Asia, Europe as well as the Americas.

This will also drive the need for rationalization of old capacity, says AMI in its report. The situation looks risky for Europe’s less profitable players where the addition of new players in Poland and Russia is likely to drive the need for upwards of 100,000 tonnes of capacity to go if Europe is to return to the 80 percent utilization rate achieved in 2010. This is the equivalent of 4 or 5 lines or potentially one or two producers.

According to AMI, demand for BOPP film grew by 4 percent in 2015. Profitability was up as companies emphasized on production efficiencies, reducing waste and the development of value-added film. This led to another up lift in capacity announcements during the year, as led by new players and new markets. However, with potentially a further 37 new lines, adding another 1.5 million tonnes of capacity in the pipeline for the period 2016-2017 utilization rates are expected to remain at around 70-75 percent. Utilization rates are also being impacted by the trend to downgauge to produce thinner films and by the development of more speciality films.

Buoyed by food industry

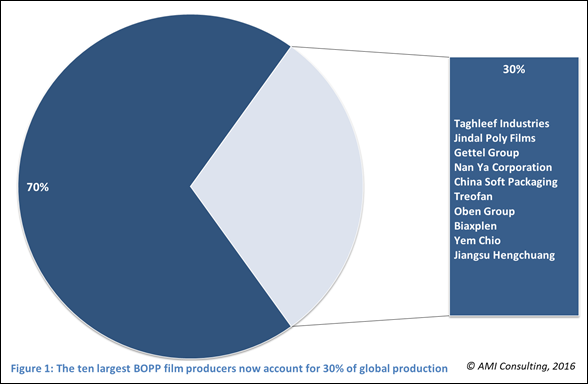

The strength of the BOPP film industry stems from the high volumes used in primary packaging, particularly for food, which are not easy to cost effectively replace. Growth in packaged foods markets around the world will continue to be a key driver for future demand underpinned by population growth, urbanization and rising incomes in developing markets. A key focus for the industry will be how to manage the demands from converters and brand owners for a global supply of BOPP film. With many customers expanding their global footprints and increasingly offering standardised solutions, they need consistent, reliable product across multiple regions, and the ability to partner with BOPP producers to achieve this. This could be a motivator to drive consolidation in the market, and there are signs this is starting to happen. The 10 largest BOPP producers now account for 30 percent of global production. This compares with 25 percent in 2011 and 27 percent in 2013. This consolidation is not just affecting heritage companies in Europe and North America, but is also leading to the emergence of new market leaders in China and South America.

Adidas

iConnectHub

iConnectHub

Login/Register

Login/Register Supplier Login

Supplier Login