"The location of the region in proximity to the European markets makes it an attractive alternative to western producers looking for low-cost production sites," explains publisher Adam Page. The MENA region has long enjoyed good economic growth, averaging over 5% per annum since 2000, on the back of rising oil prices. As this has become less dependable, many countries in the oil-producing sector are taking steps to reduce reliance on this finite resource and attract investors into non-oil industries. With some success they are offering attractive incentives in the form of tax breaks, profit repatriation guarantees and others via Free Trade Zones. The report* provides more than 150 tables and figures of exclusive data showing a comprehensive breakdown of the MENA region.

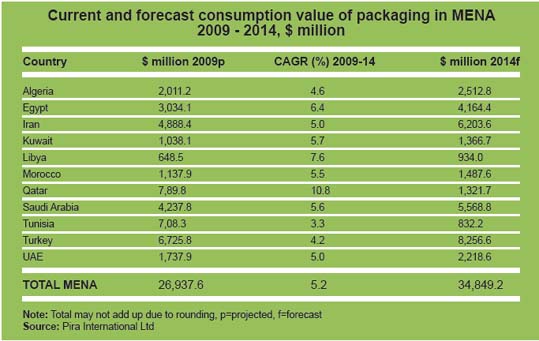

Consumption of packaging material in MENA in 2008 amounted to 19.1 million tonnes, worth $27.5 billion. According to the report, this is expected to grow by almost 4% in 2009 and on average by just over 5% annually to reach a total of 25.5 million tonnes by 2014, worth about $37 billion at 2008 prices. Qatar, Libya and Egypt will show the highest growth over the medium term, though from relatively low bases in the case of Qatar and Libya. Tunisia is expected to show the slowest medium term growth at just over 3% annually. Almost 50% of the 19 million tonnes of packaging consumed in the region in 2008 consisted of rigid packs, predominantly plastic, followed by glass and metal. Over a quarter of the volume consumed was corrugated board, whilst flexible materials made up almost 16%. Looking at opportunities by material, the report predicts that the strongest growth in demand will be for liquid packaging board, foil, flexible plastic/ laminate materials and rigid plastic and glass, these last two categories driven by strong growth in demand for beverage packaging over the review period. The healthcare sector will also provide further stimulus to packaging demand over the medium term.

iConnectHub

iConnectHub

Login/Register

Login/Register Supplier Login

Supplier Login