The global building and construction market is growing owing to the continuously increasing population and changing lifestyles. The GCC is a leading player in commodity polymers space due to cheap reserve of gas and cheaper feedstock. A report by the Gulf Petrochemical and Chemicals Association (GPCA) indicates that the polymer industry is expected to grow by 6% annually over the next five years, reaching 33.8 million tonnes by 2019.

Dr Abdullah bin Mohammad Bel Haif Al Nuaimi, the UAE Minister of Public Works said that the government plans to spend around AED 6 billion ($1.63 billion) on major infrastructure developments, including road networks and federal buildings by 2016.

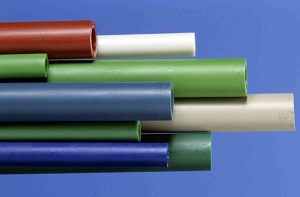

In this respect, the building and construction industry plays an important role in the development of materials for major applications such as pipes, ducts, insulation, door fittings, etc. Cladding, floor and wall insulation, water proofing, concrete reinforcement, windows and door profiles all form strong contenders for plastics' usage. Plastics are largely used in construction projects as a substitute to metals, predominantly for the manufacture of tubes and pipes.

Over the last five years, the region’s plastic production capacity has almost doubled, rising from 12.7mn tpa in 2008, to 24.7mn tpa in 2013 while for 2018 overall plastic production capacity is estimated to reach roughly 35mn tpa,” said Satish Khanna, General Manager, Al Fajer Information and Services. Mr. Khanna commented that on deploying plastics as a replacement for metal in the industry, the manufacturing and new-product development are both faster-paced and more complex than ever, with metal replacement often a key to reducing weight, cost and production times.

Mr. Satish Khanna, General Manager, Al Fajer Information and Services

Strength and resistance

Plastics have a range of high-performance resins for ultra-high strength, temperature resistance and cost-efficient production, in industries ranging from auto-making to energy production. The current trend to reduce weight will require engineering plastics for demanding components exposed to stress, vibration, heat and aggressive media.

“Manufacturers see opportunities for metal replacement in a range of uses such as manufacturing equipment to automotive engines; oil and gas exploration and extraction rigs to mobile phones and tablets. Engineering thermoplastic materials provide consistent strength and stiffness, and outstanding impact performance for metal replacement. They also offer excellent creep resistance, can maintain structural performance at high temperatures and resist corrosion, qualities metal can’t always match, according to Mr. Khanna

Engineering thermoplastic polymers are lighter and stronger than aluminium, magnesium alloy, aluminium alloy and other metals, so they offer great potential to replace traditional metal parts. Another advantage of engineering thermoplastics for metal replacement is their shorter processing cycle. Where die-casting and sheet metal construction is typically a six-step process, thermoplastics go from granules to the finished part in just three steps, which can help users get their completed product in the market sooner.

According to a Borouge report, polyolefin pipelines are well used in utility companies while PP and PE pipes are used for industrial and mining purposes. PP and PE pipes offer superior resistance to corrosion, abrasion and chemical attack. The report suggests that polyolefin materials show remarkable abrasion resistance compared to other pipe materials, especially steel where the wear-rate of PE is four to six times lower which is why it is preferred to metal pipes for mine tailing slurry lines.

PP and PE both are highly resistant to chemicals and other acids and can operate up to temperatures of 80 to 90 degrees Celsius. Borouge in the report suggested some PE Grades for industrial applications such as BorSafe HE3490-LS (a PE100 pressure pipe compound providing balance of production and properties, BorSafe HE3490-LS-H (a PE100 pressure pipe compound holding exceptional resistance to stress cracking) and BorSafe HE3490-IM (a PE100 compound with improved flow properties which made ideal injection molded fittings).

Few useful PP Grades include Beta(b) – PP BE60-7032 (a unique B nucleated grade with fine crystalline structure showcasing higher impact strength), RA130E (high molecular weight, low melt flow rate polypropylene random (PP-R) material, ideal for high temperature industrial pipe and fitting applications, Alfa(a) – BE50 and BE50-7032( nucleated polypropylene homopolymer ideally suited for non-pressure pipes and sheets and BorECO BA212E (a high modulus block copolymer polypropylene (PP-B HM), material specifically designed for cost effective production of non-pressure pipes and fittings.

The Gulf Plastics Pipe Academy in its technical documents suggests that for the piping construction sector, PE is mostly used for buried gas and water lines, becoming the most useful material. Advantages are plentiful such as: low weight, outstanding flexibility, good abrasion, corrosion and chemical resistance, safe jointing by welding and good cost-performance ratio as well.

PP and PE pipes offer superior resistance to corrosion, abrasion and chemical attack.

Meanwhile, a recent two year project commissioned by TEPPFA, the Trade Association representing manufacturers and national associations of plastic pipe systems, concluded that polyolefin sewer pipe systems have a service lifetime expectancy of at least 100 years. Polyolefin (polypropylene and polyethylene) systems have been used extensively for decades compared to their non-plastic pipe materials and they have consistently offered better long term benefits but life-time was always a tricky matter and this recent project settled that too.

At the conclusion, Tony Calton, TEPPFA’s General Manager said: "Designers, owners and operators of sewer networks can now be confident that these sewer systems will have an in-service life of at least one hundred years when materials, products and installation practices meet the appropriate requirements. The outcome is also vitally important for material suppliers, pipe manufacturers and contractors working closely with the sewer market. Clearly it will lend further appeal and allow polyolefin sewer pipes to be specified with increased confidence as they perform consistently throughout their very long asset life.”

Sufficient raw materials

The rising demand for materials to replace metal in the infrastructure sector is expected to be met with increasing capacity. Mr. Khanna said that the GCC saw an overall growth of about 11% annually over the past 10 years, driven by enhanced capacities across all major sub-sectors. “The evolving petrochemical industry in the GCC has become a leading manufacturer of commodity polymers, such as PE and PP, due to availability of cost-effective feedstock.”

According to a white paper by Frost Sullivan, a decade ago, the GCC accounted for about 11% of the total petrochemicals capacity in the world. Today, the capacity has doubled, making the GCC a major supplier through the presence of several major global chemical companies. In this scenario, plastic as replacement for metal is expected to further set the trend, especially in the building and infrastructure segments where the need for highly resistant, top performing supplies will continue to rise.

Air Jordan XX9 Low

iConnectHub

iConnectHub

Login/Register

Login/Register Supplier Login

Supplier Login