Qatar Petroleum, a state owned national oil and gas company, controls the hydrocarbon developments in Qatar. Its gas subsidiaries, Qatargas and RasGas maintain the LNG market in conjunction with seven joint venture companies.

Qatargas and RasGas together operate a total of 14 trains with liquefaction capacity of 10.29 BCF/D. With high volumes of LNG production, Qatar has been on the global map as the largest LNG exporter. The powerhouse dominates the LNG supply as it has the advantage of being located central to the major gas consuming regions such as Asia and Europe. Consequently, Qatar has been able to have a monopoly on the LNG prices. Most of Qatar’s liquefaction facilities have lower infrastructure and construction costs compared to other LNG projects. The first-mover advantage has strategically leveraged Qatar’s position to become the world’s largest LNG supplier.

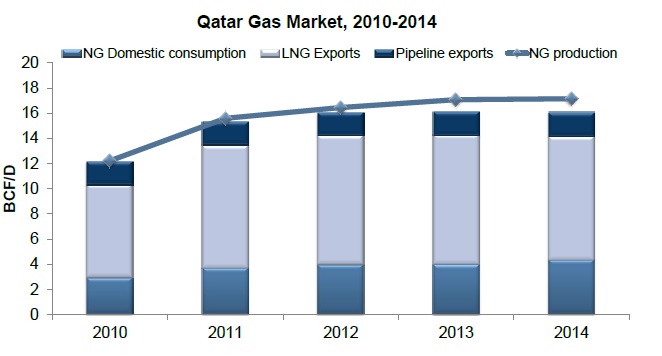

Qatar supplies over 60 percent of total natural gas produced

After meeting its domestic gas requirements, Qatar exports most of the remaining gas as LNG, as shown in the figure. Also, as highlighted in Figure 4, Qatar supplies LNG to most of the gas-deficit regions, with Asia-

Pacific being its largest LNG consumer. Qatar is able to capture 90% of the Asia-Pacific gas demand market and has existing long-term LNG contracts with Japan, South Korea and India.

Qatar has the potential to manage its LNG supply. In 2005, the Qatari Government decided to stop the expansion of The North Field in order to maintain the future LNG supply. The objective of this moratorium was stated as to evaluate The North Field reservoir. Initially this was supposed to be implemented for a year, however the moratorium is still in place and the Qatar Government is not likely to revoke this anytime soon.

In 2014, Qatar’s LNG supply dropped down to 9.85 BCF/D, which was a 4.2 percent decline from 2013 supply volumes. This has been mainly because of Qatar’s high domestic gas consumption along with the decline in international oil prices that has led to lower LNG demand. Going forward, the domestic gas consumption in Qatar is likely to increase at a high rate, which will influence the future LNG supplies from Qatar.

Qatar to face stiff competition from the US and Australia

The LNG industry is progressing at a fast pace, with high demand coming from the Asia-Pacific regions, especially Japan, China and India. With such surge in LNG demand, the gas-rich countries are vying aggressively to supply LNG to these countries.

The shale gas development in the US has made LNG exports a potential opportunity that is likely to have tremendous impact on the dynamics of the future LNG trade.

The major LNG projects in the U.S. have received Federal Energy Regulation Commission (FERC) approval and are likely to start delivery by late 2015. These projects include Sabine Pass, Corpus Christi, Cameron LNG, Cove Point LNG and Freeport LNG, with a total capacity of 9.22 BCF/D. Meanwhile, the remaining LNG liquefaction projects that have still not received their Final Investment Decision (FID) are likely to get delayed as a result of low oil prices. These projects are likely to start construction once the market conditions recover with oil prices hovering around $ 80/barrel. This will take the total U.S. LNG export capacity to around 14 BCF/D.

Australia is the third largest global LNG supplier with around 3.34 BCF/D of LNG exports in 2014. In the last five years, Australia has invested more than $200 billion in LNG liquefaction projects. Once these projects commission, this will not only increase its current LNG supply volumes but enable Australia to surpass Qatar’s LNG supply levels.

Australia’s new liquefaction projects are nearing completion and are expected to debut online post 2015. By 2018, country’s liquefaction capacity will reach around 11.50 BCF/D. Assuming the new LNG projects will operate at 95% utilization rate, Australia’s LNG exports will be around 10.91 billion ft3/d. In addition to this, Australia has signed long-term contracts with Japan for supply of LNG.

Going forward, stunted gas production in Qatar coupled with no new upcoming LNG projects is likely to lead to steady LNG export volumes. With intense competition from Australia and the U.S., Qatar’s position as the largest global LNG supplier will no longer prevail.

Therefore, unless the Qatari Government decides to revoke the moratorium on The North Field, Qatar will continue to face challenges in terms of its LNG exports.

ADIDAS

iConnectHub

iConnectHub

Login/Register

Login/Register Supplier Login

Supplier Login