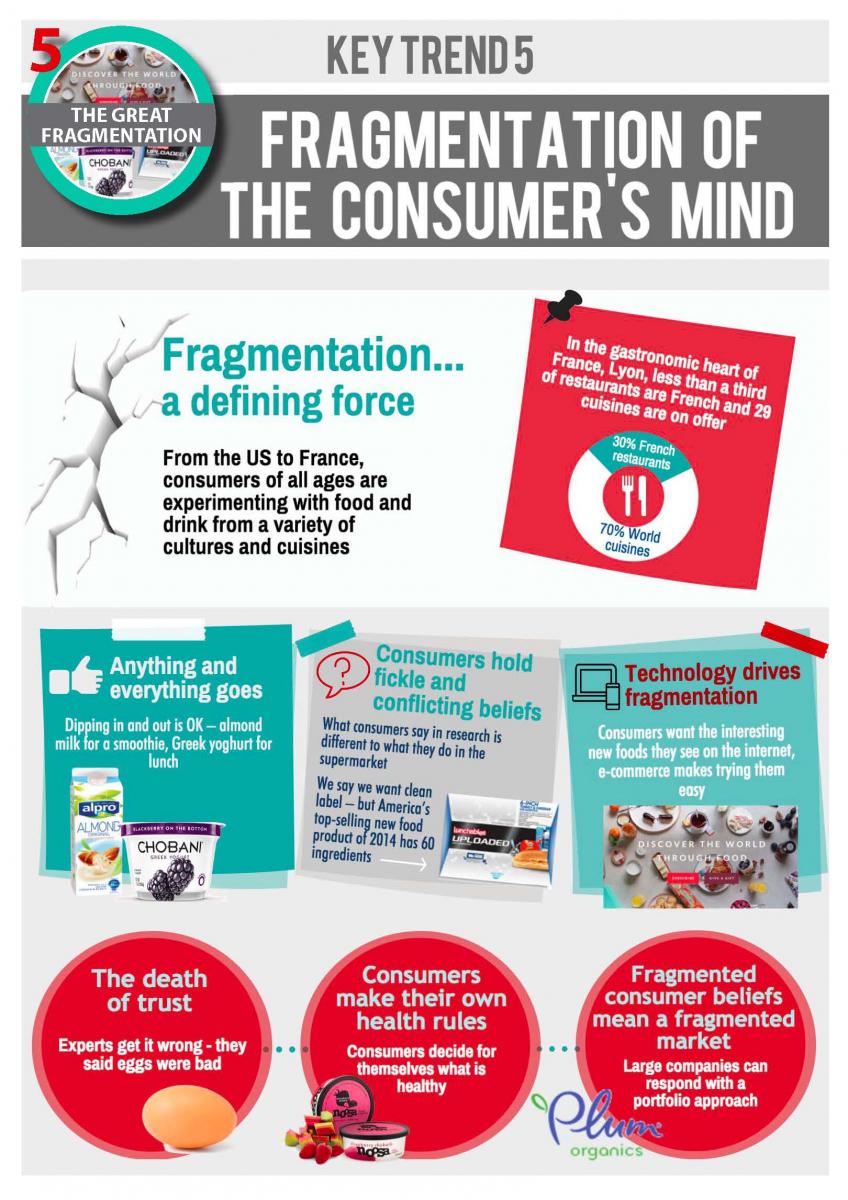

THE fragmentation of consumers’ beliefs about health is a trend that is leading to the break-up of traditional food and beverage markets. It has also started ushering in more opportunity for start-ups and small brands.

“Big food companies are being forced to rethink their business models,” said Julian Mellentin, director of New Nutrition Business and author of 10 Key Trends in Food, Nutrition and Health 2016. He said the Great Fragmentation, which is Key trend #5 in his list, explains how high volume opportunities are scarce and becoming scarcer. In some markets they may already be history.

The shift in the food landscape is influenced by 25 years of digital sampling, mash-ups, music sampling, remixing, restaurant fusion food – all an established part of the culture that surrounds people. Consumers ideas’ about food and health have become a menu of choices from which they select and change as new information becomes available.

This is producing a proliferation of niches that smaller companies and new brands – often premium – are perfectly placed to serve.

In the future, smart companies will only rarely launch mass-market brands aiming to rapidly get high volume. Instead they will build portfolios of small brands, finely targeted at an ever-more fragmented consumer market. A few of these will become big brands, some will be big niche, most will remain niche.

General Mills is an example of a large and more visionary company that is already embracing the change. Going with the flow, it has established the 301 Inc. business unit to invest in entrepreneurs and early stage food companies.

“The rapidly evolving consumer landscape is dramatically changing the game in the food industry,” said John Haugen, general manager of 301 Inc. “Tremendous opportunity exists...to partner with and foster emerging food brands.”

The new model and the growth of the flexitarian

The Great Fragmentation model will become the standard for large food and beverage businesses. The market-redefining power of this trend is illustrated by Key Trend 7: Plant-Based Foods and Beverages. Non-dairy plant “milks” such as almond milk have seen sales jump by between 20% (Spain) and 50% (US).

While it may seem that this trend is led by beliefs in veganism or vegetarianism, it is not. What drives it is consumers’ love of variety and novelty. Most consumers are flexitarians, for instance using cows’ milk on our cereal, almond milk in our smoothies and coconut milk in our cooking as it suits us. And the halo of health and sustainability around plant-based foods means consumers feel good about their choices.

This trend has also been made possible by massive improvements in the taste of plant-based foods (which accounts for almond milk’s rise at the expense of soy milk), and by technical advances that make it easier to include plant-based ingredients such as beans and seaweed in good-tasting snack formats.

Effect on beverage market

Fragmentation also underpins Key Trend 1: Beverages Redefined. Even big beverage companies are seeing their sales peak. Demand for soft drink falling, while fruit juices struggle. Meanwhile small niche drink brands are reshaping the market.

According to Melletin, plant waters - a $4 billion market by 2025 - including products like coconut and birch water meet consumer’s demand for healthy products that do not contain additives, are naturally low in calories and sugar, and sustainable.

Shop Womens Socks - View the Large Range

iConnectHub

iConnectHub

Login/Register

Login/Register Supplier Login

Supplier Login